Las Vegas–based data center operator Switch has raised $659 million through its fourth asset-backed securities (ABS) offering, bringing its total funding from such issuances to $3.5 billion. The ABS structure ties financing to Switch’s revenue generating data center assets. The newly issued bonds qualify as green bonds, reflecting the company’s commitment to sustainable infrastructure and environmentally responsible data center design. Proceeds will fuel DigitalBridge owned Switch’s ongoing expansion strategy, supporting development across its five major campuses designed to serve hyperscale, enterprise, and AI-driven workloads.

“The success of this transaction, and the continued growth of our platform, demonstrate that our strategy, combining advanced technology with exascale campus deployments in Tier 1 markets resonates with both customers and investors,” said Madonna Park, CFO of Switch. Park added that as Switch’s multi-tenant and hyperscale assets stabilize, the company intends to remain active in both ABS and broader capital markets.

“With nearly $6 billion in stabilized asset financings completed to date, we have the scale, efficiency, and proven performance to continue recycling capital effectively enabling leading AI, cloud, and enterprise customers to scale with Switch.”

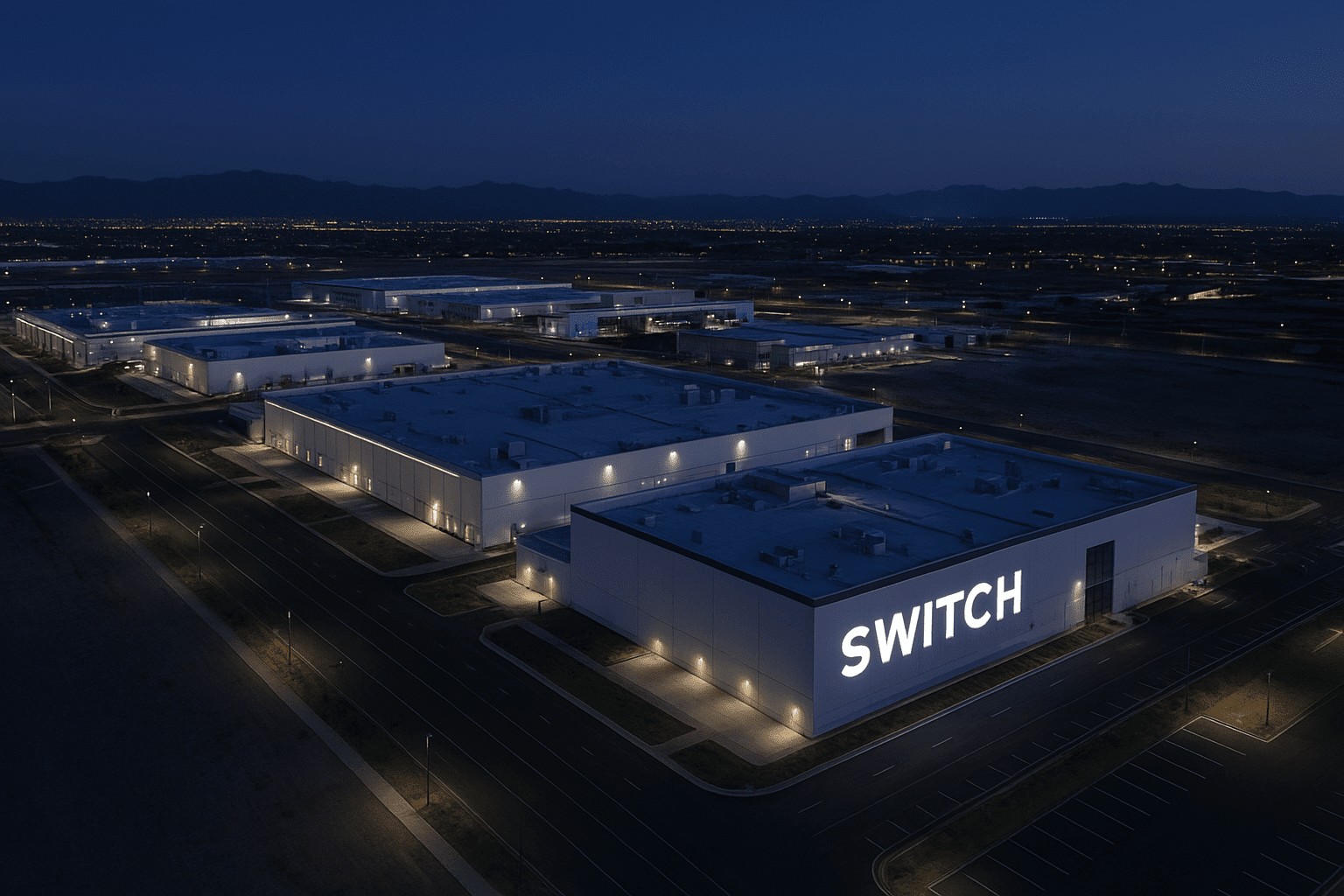

Founded in 2000, Switch operates its flagship Prime Campuses in Austin (TX), Reno and Las Vegas (NV), Grand Rapids (MI), and Atlanta (GA), with ongoing expansions in Austin and Atlanta. In July 2025, the company unveiled plans for smaller, high-density data centers optimized for AI workloads. The company’s Core Campus in Las Vegas will deliver up to 495MW of capacity at full build-out. Switch’s proprietary designs include hot-aisle containment and liquid cooling capabilities notably hosting an Nvidia GB300 NVL72 deployment for CoreWeave, an AI cloud provider.

Switch was taken private by DigitalBridge and IFM Investors in a $11 billion transaction in December 2022. In 2023, Aware Super, an Australian pension fund, invested $500 million, and reports suggest the company may now be exploring a return to public markets.