Nuclear energy is rapidly moving to the center of the debate over how to power the explosive growth of AI and high-performance computing. As data centers consume record levels of electricity, operators are confronting tightening grids, long interconnection delays, and rising reliability risks. To sustain 24/7 operations and achieve the 99.999% uptime the industry demands, many are now seriously evaluating nuclear power as a source of resilient baseload energy and long-term stability.

Against this backdrop, new commercial partnerships and feasibility efforts across the United States indicate growing confidence that advanced nuclear reactors, including next-generation microreactors, could play a significant role in powering the data infrastructure of the future.

Data Centers Are Turning to Nuclear- why?

Unlike intermittent renewable sources, nuclear power plants operate continuously and at full capacity more than any other energy source, supplying 24/7 electricity that aligns with the nonstop operations of data centers. Today’s reactors run for 18 to 24 months before requiring refueling, and planned outages typically last only a few weeks, helping avoid unplanned downtime that can cost data centers more than $8 million per day. New accident-tolerant fuels in development could extend these cycles even further, and some advanced reactor designs aim to operate up to 10 years without refueling.

The scalability of nuclear solutions is also drawing attention. Next-generation reactors range from transportable microreactors to small modular reactors and full-scale light-water plants capable of serving facilities from 10 megawatts to several gigawatts. As electricity needs rise, some future data centers may require 4 GW or more, such flexibility is increasingly critical.

Nuclear plants also offer predictable long-term pricing, as most costs are tied to capital and labor rather than uranium fuel. Newer compact reactor designs could be colocated directly with data centers to reduce transmission costs and enhance energy security, especially for mission-critical AI and military facilities. This model is beginning to appear in practice: Microsoft and Constellation Energy signed a 20-year agreement in September 2024 to restart Three Mile Island Unit 1 for data center operations, and other companies are exploring colocated infrastructure at sites such as the Susquehanna Steam Electric Station in Pennsylvania and the Surry Nuclear Power Plant in Virginia.

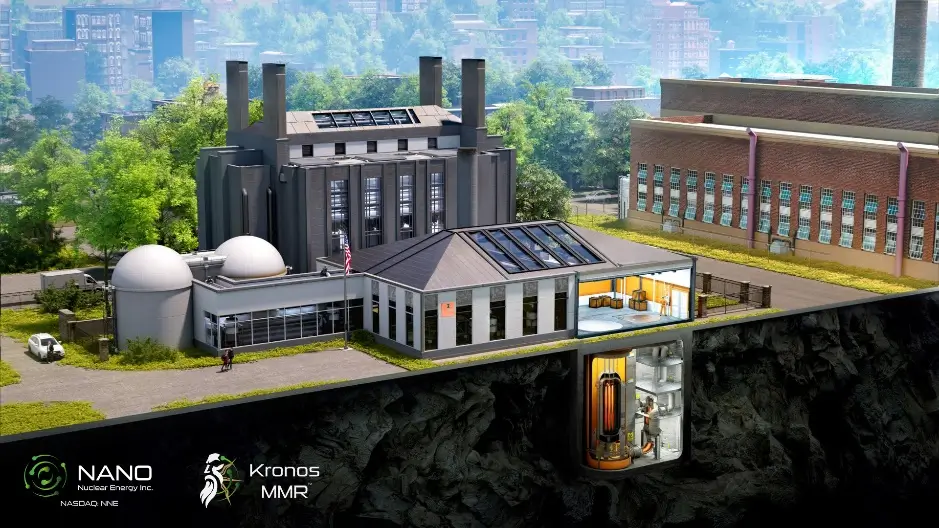

One of the clearest signs of momentum is a new agreement between NANO Nuclear Energy and BaRupOn LLC. The companies recently signed a Feasibility Study Agreement to evaluate deploying many KRONOS MMR™ microreactors to supply 1 gigawatt of nuclear power to BaRupOn’s 701-acre Liberty American Multi-Sourced Power (“LAMP”) and Innovation Hub in Liberty, Texas. The assessment will examine projected power demand, integration requirements, and the suitability of land and site access for hosting the reactors onsite. BaRupOn will compensate NANO Nuclear for completing the study.

BaRupOn anticipates a significant power shortfall across Texas and the broader United States due to accelerating AI and high-performance computing requirements, and has signaled willingness to co-invest in microreactor construction if the feasibility process moves forward. The LAMP campus, near Houston, is being developed as a multi-domain innovation hub focused on AI computing, robotics, autonomous systems, defense technology, and next-generation industrial research, and may deploy multiple KRONOS MMR™ units to secure dedicated, always-on, emission-free energy. Doing so could reduce dependence on strained regional grids and support long-term operational resilience.

Rendering of NANO Nuclear Energy’s Patented KRONOS MMR® Micro Modular Reactor Energy System.

The KRONOS MMR™ is a high-temperature, gas-cooled microreactor using TRISO particle fuel and helium coolant for inherent safety and reliability. It is designed for modular deployment, allowing scalable clusters capable of reaching gigawatt-class output. NANO Nuclear leaders say the study could represent a milestone in commercial development and help meet rapidly expanding power needs from high-energy-intensive sectors.

Challenges

Though interest is growing, nuclear deployment faces obstacles. Licensing and constructing new reactors takes years. First-of-a-kind projects carry high upfront costs. Regulatory questions around behind-the-meter energy distribution have also surfaced, as seen when the Federal Energy Regulatory Commission paused efforts to expand similar arrangements following Amazon and Talen Energy’s $650 million deal tied to the Susquehanna Steam plant. Meanwhile, the domestic supply chain for high-assay low-enriched uranium (HALEU), essential for many advanced reactors, is still being established. And spent nuclear fuel must continue to be safely stored until long-term disposal pathways are finalized.

Early siting efforts like the BaRupOn initiative in Texas and agreements to restart existing reactors point toward a growing shift in how the technology sector approaches energy security. If feasibility studies succeed and advanced reactor deployment accelerates in the 2030s, nuclear-powered data campuses may become a cornerstone of the AI era, supporting the next generation of digital infrastructure with resilient, emissions-free power.