On paper, 2025 should have been a breakout year for data center REITs. Global cloud spending reached $419 billion, AI workloads intensified hyperscaler capital expenditure, and digital infrastructure demand continued to climb. In that environment, landlords of mission-critical compute facilities would be expected to deliver accelerating payouts.

Yet Digital Core REIT closed FY2025 with its Distribution per Unit unchanged at 3.60 US cents.

At first glance, that feels inconsistent with the sector’s momentum. However, a deeper look suggests the flat DPU reflects timing effects, portfolio repositioning, and valuation normalization rather than operating weakness.

Revenue Growth Was Real, but Margins Tell the Story

The top line was undeniably strong. Gross revenue rose 72% year over year to approximately $176 million. Net Property Income increased 43%. Portfolio AUM climbed 13%, supported by leasing momentum and contributions from Frankfurt and Osaka.

However, the gap between revenue growth and NPI growth deserves attention. Operating costs rose meaningfully, particularly utilities and maintenance. In high-density data centers, rising power consumption translates into higher infrastructure strain and cooling demands. While these costs are typically recoverable to some extent, margin expansion does not always keep pace with revenue growth.

As a result, strong top-line performance did not translate into proportional distributable income growth. Core distributable income rose just 1.9%. That modest increase helps explain why DPU held steady instead of climbing.

Linton Hall: A Reset Year

The Linton Hall facility in Northern Virginia became a swing factor in 2025.

Following a customer churn event, occupancy temporarily declined before management executed a rapid lease-up. Within six months, occupancy recovered from 81% to 98%, and the new lease reportedly delivered a 35% increase in net rent compared to the prior tenant.

Operationally, that outcome is impressive. Financially, however, there was an interim impact. Any gap between tenants in a high-value asset creates short-term pressure on earnings, even if the long-term contract terms are stronger.

In other words, 2025 absorbed part of the reset. The benefits of higher contracted rent should be more visible in forward periods.

The Accounting Optics: Profit Down, Cash Flow Stable

Net profit fell sharply year over year. That headline could alarm casual observers. However, the decline was largely driven by a reduction in fair value gains on investment properties.

In FY2024, the REIT recorded substantial valuation gains. In FY2025, those gains normalized significantly. Fair value movements are non-cash and market-sensitive. They affect reported earnings but do not directly determine distributable income.

Crucially, distributable income to unitholders edged higher and DPU was maintained. From an income investor’s perspective, the accounting volatility matters less than the stability of cash distributions.

Capital Discipline in a Higher-Rate Environment

Digital Core REIT also demonstrated measured capital management.

Aggregate leverage stands at 37.1%, leaving substantial headroom below the 50% regulatory ceiling. The average cost of debt remains at 3.5%, with 85% of borrowings fixed-rate. Interest coverage at 3.5x is adequate, though not exceptionally conservative.

The REIT repurchased 1.8 million units at an average price of $0.565, adding modest DPU accretion. It also established a $750 million euro medium-term note program, broadening funding access.

These actions suggest prudence rather than aggressive expansion. In a sector where power constraints and regulatory hurdles are tightening supply, balance sheet flexibility is a strategic asset.

Sector Tailwinds vs. Structural Constraints

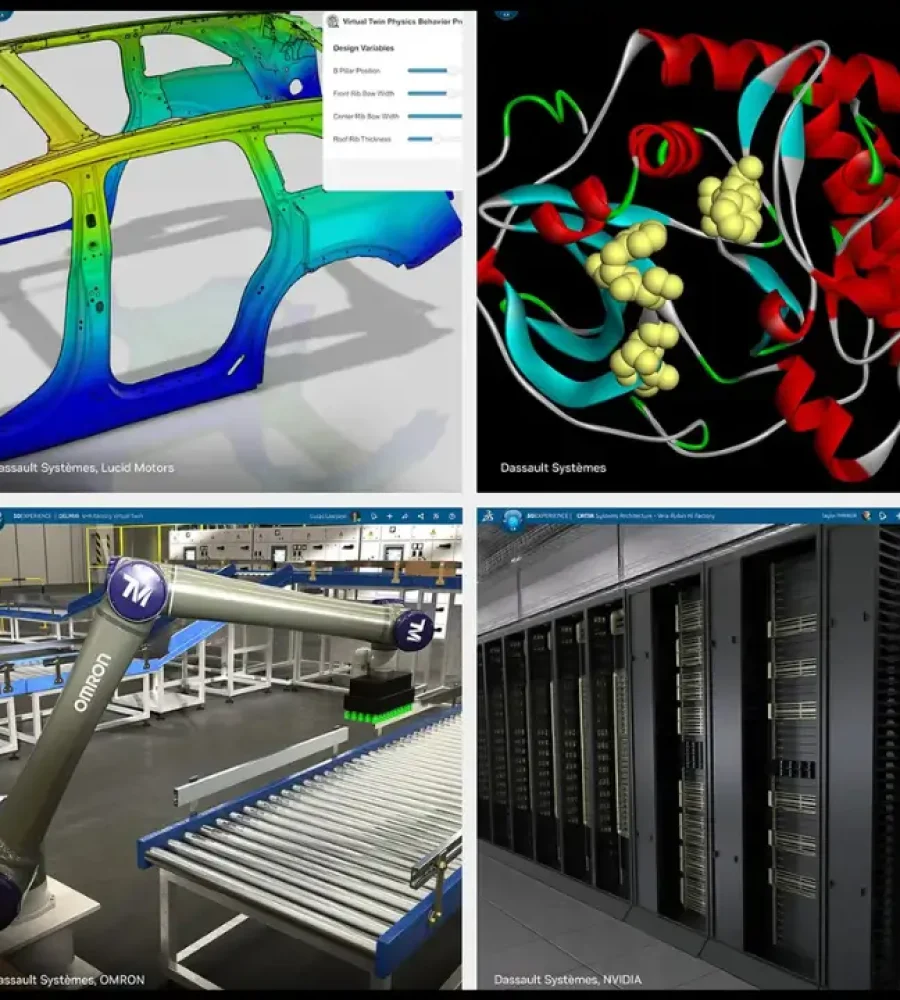

The broader digital infrastructure backdrop remains constructive. AI workloads continue to increase power density requirements. Cloud providers are expanding globally. Barriers to entry are rising in key markets such as Northern Virginia and Toronto due to grid limitations and regulatory screening.

For existing operators, these constraints can support pricing power. However, they also raise capital intensity and execution complexity.

Digital Core REIT’s portfolio now spans North America, Europe, and APAC, including investments in Frankfurt and Osaka. This geographic diversification reduces single-market risk. Still, tenant concentration remains high, with the top 10 customers accounting for a substantial majority of rent. That concentration must be monitored carefully.

The flat DPU in FY2025 does not signal a deteriorating business. It signals a transitional year.

Revenue expanded materially. Occupancy improved to 97%. Lease terms strengthened in key assets. The balance sheet remains stable. Yet cost pressures, tenant churn timing, and normalized valuation gains muted distributable growth in the short term.

In effect, 2025 was a year of repositioning rather than acceleration.

The Outlook for 2026

At a unit price around $0.51, the REIT offers a distribution yield of roughly 7%. For income-focused investors, that yield is supported by high occupancy and long-term digital infrastructure demand.

The key question for 2026 is whether higher contracted rents and stabilized occupancy translate into measurable DPU growth. If they do, FY2025 may be viewed in hindsight as a consolidation year before renewed expansion.

If they do not, investors may begin to question whether rising operating intensity in the AI era structurally caps margin growth for data center REITs.

For now, the evidence suggests resilience rather than stagnation. The growth is visible in the assets. The challenge is converting that growth into faster per-unit income expansion.

That conversion will define the next chapter.