The cloud infrastructure market has entered a new era of growth, fueled by unprecedented enterprise demand for generative AI workloads. According to the latest findings from Synergy Research Group, the global cloud market surged to $419 billion in 2025, driven by another quarter of accelerating year-on-year expansion. In the fourth quarter alone, cloud revenues climbed to $119 billion, reflecting growth that hasn’t been seen in more than three years.

What’s remarkable about these figures is how rapidly spending is accelerating, especially as companies shift from experimenting with AI to deploying it at scale.

Skyrocketing Growth: Beyond Historical Norms

Cloud infrastructure services, including infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS), and hosted private cloud offerings, accounted for a total of $119.1 billion in revenue in Q4 2025. Compared to the previous quarter, enterprise spending jumped roughly $12 billion, and when measured against the same period in 2024, it expanded by $29 billion.

Synergy’s analysts describe these jumps as far larger than anything previously recorded in the cloud market’s history, a notable statement given that the cloud industry has posted strong double-digit growth for years. But the pace of expansion in late 2025 suggests an inflection point: enterprises are no longer dipping their toes in AI and cloud, they are diving in headfirst.

For the full year, total cloud infrastructure revenues reached $419 billion, representing about 30 % year-on-year growth once adjustments are made for currency fluctuations. This marks the ninth consecutive quarter in which yearly growth has increased compared to the previous period, a sustained acceleration that points to structural demand rather than a short-lived spike.

At the heart of this boom is generative AI. Once considered an experimental frontier, AI workloads have become central to cloud infrastructure consumption. Large-scale models, GPU-intensive training clusters, and AI-driven applications are consuming vast amounts of cloud compute and storage, driving up spending across enterprises of all sizes.

Who’s Winning the Cloud Race?

As expected, the largest cloud vendors still capture the lion’s share of market revenue, but the competitive landscape is also shifting.

- Amazon remains the clear market leader, holding 28 % of global cloud infrastructure revenues in the fourth quarter. Its breadth of services and depth of global infrastructure continue to make it the go-to choice for many large enterprises.

- Microsoft secured 21 % of the market, and Google accounted for 14 %, both posting strong growth rates that outpaced the broader market. Microsoft’s success reflects its deep penetration in enterprise IT environments, while Google’s focus on AI-optimized services is resonating with developers and data scientists alike.

While the top three providers dominate overall market share, several other companies are making impressive gains by specializing in AI and high-performance compute:

- CoreWeave, which had virtually no cloud revenue just a couple of years ago, is now generating more than $1.5 billion in quarterly revenue. Its rapid rise has been propelled by GPU-heavy infrastructure tailored for AI model training and inference.

- OpenAI, Oracle, Crusoe, and Nebius also emerged as fast-growing providers in the broader ecosystem, signaling that niche players with strong AI value propositions can thrive alongside hyperscalers.

Public Cloud Drives the Majority of Growth

Much of the recent surge in cloud spending is concentrated in public IaaS and PaaS offerings, which together represent the largest segment of the market. In Q4 alone, this segment grew by 34 %, outpacing overall cloud infrastructure expansion.

The dominance of public cloud is especially clear when considering market concentration: the top three providers: Amazon, Microsoft, and Google- account for roughly 68 % of this space. While private cloud and hosted services continue to play meaningful roles in specific enterprise environments, public cloud remains the primary engine of growth.

This trend aligns with how companies are deploying AI. Public cloud platforms offer the scalability, geographic reach, and specialized hardware (including GPUs and TPUs) required to support modern AI workloads, from training large language models to running real-time inference engines powering business applications.

Geography of Expansion: A Global Phenomenon

Every major region across the world experienced robust cloud spending growth in the fourth quarter, demonstrating that the acceleration isn’t limited to a few tech-heavy markets.

The United States continues to be the largest single market, surpassing the combined scale of the entire Asia-Pacific region. U.S. cloud spending grew about 30 % in Q4, a clear indicator of enterprises committing major budget dollars to digital transformation and AI initiatives.

Beyond the U.S., a number of countries grew faster than the global average when measured in local currencies. These included:

- Australia

- India

- Indonesia

- Ireland

- Mexico

- South Africa

- Taiwan

In Europe, although larger markets like the United Kingdom and Germany remain central hubs for cloud demand, several smaller countries, notably Ireland, Poland, and Sweden, recorded some of the highest regional growth rates.

This broad geographic expansion underscores how cloud and AI adoption have become priorities not just in technology hubs but across diverse economic environments and industries.

AI: From Pilot Projects to Production Reality

One of the most striking aspects of the cloud market’s recent trajectory is the shift from early experimentation with AI to large-scale production deployments.

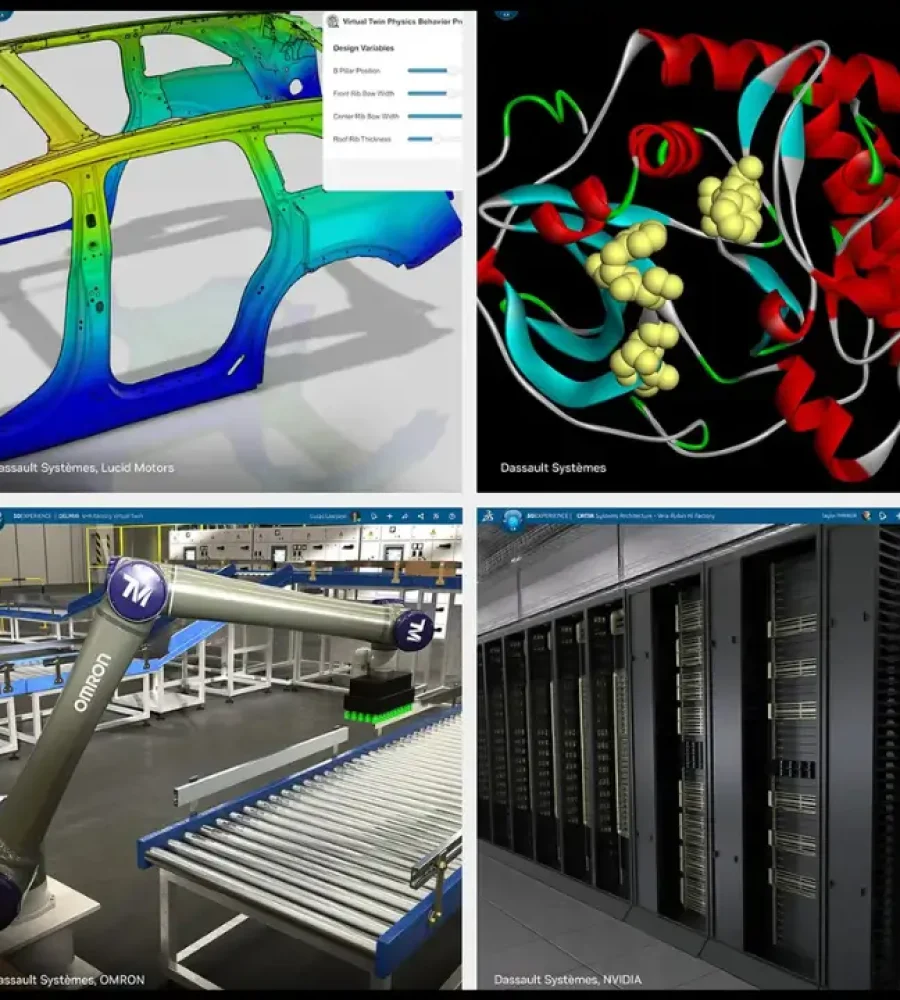

In earlier years, many organizations treated AI projects as pilots or proofs of concept, exciting, but not critical. Today, companies are embedding AI deeply into core business functions: from customer support automation to supply chain optimization, product design, and data analytics.

This shift is mirrored in the broader tech landscape:

- Analysts tracking cloud infrastructure spending have noted sustained growth above 20 % for multiple consecutive quarters.

- App-usage data shows massive increases in adoption of generative AI tools, with U.S. mobile usage of AI chatbot apps expanding rapidly and shifting market share among leading players.

These demand trends are returning tangible results for cloud providers, whose revenue growth rates have jumped in lockstep with broader enterprise adoption of AI services.

What Comes Next? A Plateau or Continued Expansion?

Growth at this scale rarely continues indefinitely. There will likely come a point where cloud spending growth, even in AI-driven markets, moderates. That said, several structural factors could sustain elevated growth for years:

- Continual advances in AI research and development will drive demand for more powerful, specialized compute resources.

- Organizations are increasingly embedding AI across business operations rather than treating it as an isolated function.

- Cloud platforms continue to innovate, offering new services that simplify AI deployment and reduce the cost of entry for enterprises.

However, how quickly AI becomes an integral part of every digital initiative, rather than a strategic differentiator in isolated sectors, will influence future cloud spending patterns.

For now, the cloud industry appears to be in a prolonged expansion phase. Strong earnings, diversified geographic demand, and the shift from AI experimentation to large-scale implementations all point to sustained investment in cloud infrastructure.

Cloud’s Defining Moment

The 2025 cloud market, with $419 billion in annual revenue and a record-breaking fourth quarter, represents more than just another earnings milestone. It reflects a fundamental shift in how enterprises allocate technology budgets, prioritize digital transformation, and scale AI-powered innovation.

Generative AI is one of the primary forces reshaping enterprise IT strategy and anchoring long-term demand for cloud services.

As cloud providers adapt to this new reality by building more AI-centric services, and enterprises increasingly integrate AI into core operations, the landscape of enterprise IT may look very different just a few years from now.