The robotics conversation has shifted. Headlines exalt humanoid prototypes and generative models that can plan a grasp in simulation; venture capital flows chase charisma and code. Yet, for any company that aims to turn robotics into durable commercial value, the battlefield sits squarely on factory floors, assembly lines and the invisible architecture that binds machines into productive systems. In short: hardware and manufacturing integration – not AI demos alone, will determine which firms survive and scale.

Global demand for industrial robots remains robust. Factories installed record numbers of robots in recent years as manufacturers doubled down on automation to tighten supply chains and raise throughput. This uptake shows that customers buy reliability, repeatability and total cost of ownership attributes shaped by manufacturing scale and service networks, not by a flashy perception model.

The Operational Edge in Robotics

Consider what customers actually pay for. An automotive plant, an electronics contract manufacturer or a packaged-goods line does not purchase novelty; it buys throughput, predictable uptime and clear return-on-investment windows. They require robots with certified safety, long-term spare parts availability, field service staff and well-documented integration with PLCs, MES and enterprise resource planning systems. These capabilities arise from mature manufacturing processes, supply-chain depth and global service footprints assets that take years and billions to assemble. Consequently, a startup that demonstrates a humanoid doing a graceful motion in a lab still faces a far longer, costlier path to mass industrial deployment than an incumbent that can ship tens of thousands of arms with established service contracts.

Scale reduces unit cost and raises robustness. The industrial-robot market recently showed signs of fragmentation even as global deployment rose, with smaller players making inroads while top vendors’ combined market share eased. That shift matters: when manufacturers diversify suppliers, they prize standardized interfaces, predictable lead times and local support. Companies that have optimized production lines, vendor relationships and logistics can adjust prices, improve margins and win volume orders even against better-funded AI-first challengers.

Manufacturing Scale Is the Real Moat in Robotics

Integration beats isolated intelligence. AI contributes clear advances in perception, adaptive control and anomaly detection; it can make robots less brittle. Still, embedding AI into industrial contexts requires orchestration, integration with real-time control systems, compliance with safety standards, predictable latency handling and lifecycle management for both software and firmware updates. In many factories, the integration burden outweighs the marginal gains an advanced model provides. Thus, vendors who couple AI capabilities with hardened engineering, rigorous validation and long-term maintenance commitments will close deals more often than those who sell AI as a standalone value proposition. Independent analysts and industry reports underline this pragmatic mindset in procurement teams across sectors.

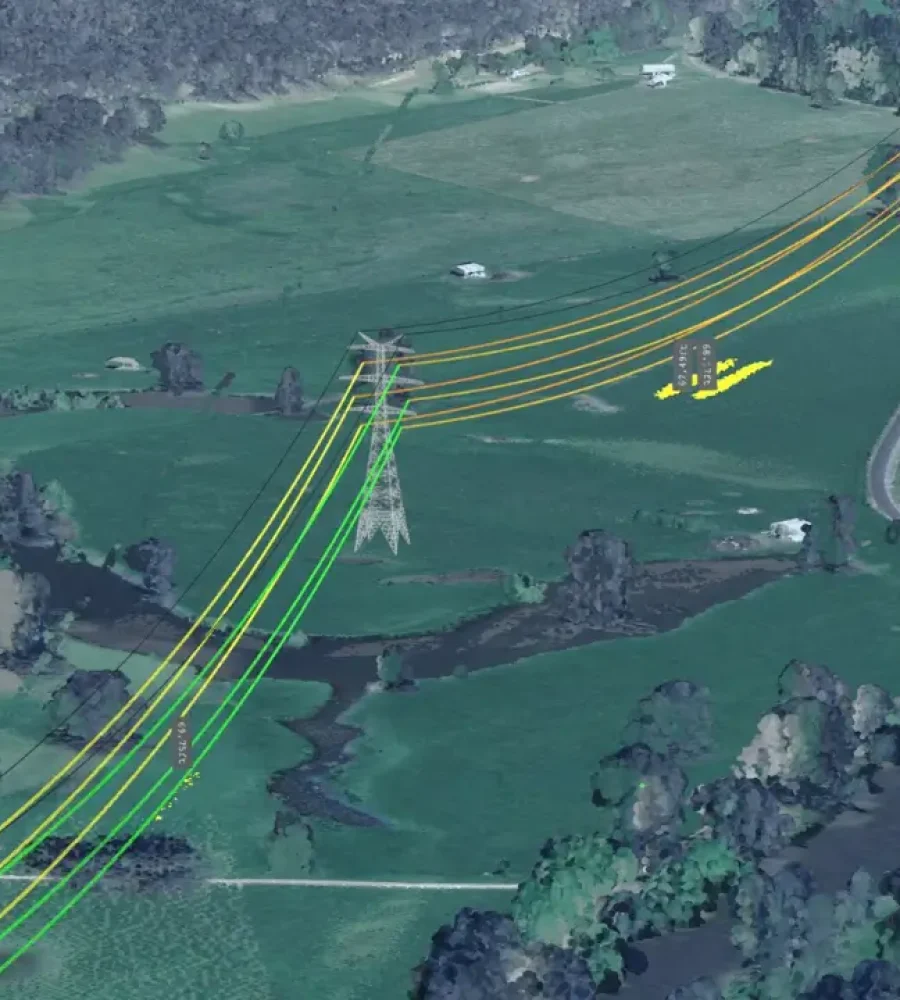

Geopolitical and capital flows color winners. China has scaled robot installations rapidly, leveraging coordinated industrial policy and domestic supply chains to expand automation across sectors. That scale creates local demand advantages and accelerates learning curves for manufacturers that operate nearby. Meanwhile, corporate restructurings and strategic sales among established Western suppliers reflect an industry recalibration: firms reevaluate how best to marry software ambitions with manufacturing realities. These moves matter because they reshape who controls manufacturing capacity, intellectual property and customer relationships the levers that convert innovation into commercial dominance.

Fifth, the business model matters as much as the machine. Subscription and “robot-as-a-service” offerings hinge on predictable hardware supply and low field-failure rates. Leasing and outcome-based contracts require strong financing partners and spare-parts ecosystems so customers can rely on continuous operation. Firms that can amortize production costs across many customers and offer responsive service will undercut rivals who depend on one-off sales and high-margin, low-volume experiments.

Integration, Service and Lifecycle Control Define Commercial Viability

For entrepreneurs and investors, the strategic implication follows directly: prioritize manufacturability and integration early. Design for serviceability. Instrument parts for predictive maintenance. Standardize interfaces so integrators can roll out solutions without months of custom software. Build supply chains with redundancy and nearshoring options that reduce geopolitical risk. In other words, treat hardware like software teams treat continuous integration as the product and the product’s future.

This emphasis on manufacturing does not downplay AI’s role. Rather, it reframes AI as an enabler embedded in a larger system. When models improve perception, they reduce cycle times and scrap. When they predict failures, they cut downtime. Yet these gains compound only when companies have the manufacturing discipline to deliver millions of cycles in real environments, to iterate firmware safely, and to support customers across continents. AI without manufacturing depth risks becoming a demo that fails to translate into revenue at industrial scale.

There is also a macro-economic argument. Manufacturing-led automation rebalances labor pools, alters regional competitiveness and changes the calculus of industrial policy. Governments that subsidize factory modernization, fund skills development and support downstream service industries will amplify the advantages of firms that can deploy at scale. Conversely, countries that focus solely on AI research without industrial modernization may house impressive labs but miss out on the broader economic value chain that accrues to producers and integrators.

Capital Discipline and Industrial Policy

Finally, the timeline to dominance favors those who excel in both hardware and systems engineering. Incumbent firms possess distribution networks, customer trust and the ability to absorb manufacturing shocks. Emerging firms can outcompete them by focusing relentlessly on the operational constraints of customers, runtime, safety, maintainability and predictable cost. Investors should therefore value demonstrated deployments, repeatable revenue, and service metrics as highly as algorithmic novelty.

To be clear, the winners in robotics will likely be hybrid organizations: companies that pair robust manufacturing footprints with compelling AI capabilities and customer-centric business models. Startups that succeed will do so by marrying nimble software innovation with pragmatic hardware strategies not by hoping perception breakthroughs alone will carry them across the chasm into industrial adoption.

In the near term, market signals point toward pragmatism. Manufacturers continue to invest in robots because they solve tangible problems; governments and large buyers prioritize reliability and total-cost clarity; and vendors that can ship at scale while supporting customers locally gain privileged access to long-term contracts. Therefore, while AI will reshape what robots can do, manufacturing with its rigour, scale and systemic requirements will decide who wins.