It’s only early 2026 and hyperscale cloud and AI infrastructure spending is surging to unprecedented levels. But, markets are signaling caution. The largest cloud providers and tech giants are committing an estimated $650 to $690 billion in capital expenditures for 2026, nearly double the prior year’s total, as they race to expand AI-ready compute, data centers, and networking capacity. At the same time, stock prices have been volatile, with some bellwethers slipping into bear market territory and analysts increasingly questioning whether such aggressive build-outs can deliver sufficient near-term returns.

This tension gives rise to a central question for investors: Is this wave of spending a rational response to long-term structural demand, or does its sheer scale signal the formation of an AI bubble?

The Case for Bullishness: Building the Foundation of Tomorrow

1. Hyperscalers Are Doubling Down on AI Demand

Amazon, Alphabet, Microsoft, Meta, and Oracle are projected to spend staggering sums on AI-oriented infrastructure in 2026. These commitments reflect a shared conviction that AI workloads represent the next era of enterprise computing. Supporting that shift requires enormous expansions in GPUs, servers, storage, and advanced networking.

Importantly, this investment is not occurring in isolation. Major cloud providers report growing backlogs, suggesting sustained enterprise demand. Corporate customers are signing long-term AI contracts that secure future revenue streams even before the hardware is fully deployed. For long-term investors, this resembles the foundational build-outs that historically precede transformative growth. The early internet required vast investments in fiber, data centers, and connectivity before its economic impact became clear. AI may be following a similar trajectory, with capital investment laying the groundwork for future returns.

2. Productivity and Monetization Pathways Are Emerging

Although infrastructure spending currently exceeds direct AI-related earnings, early signs of monetization are taking shape. Cloud services continue to expand year over year, and AI capabilities are increasingly embedded into revenue-generating products, from enterprise SaaS tools to consumer applications.

History suggests that this pattern is not unusual. Rapid technology adoption cycles often begin with heavy capital expenditure before productivity gains and revenue acceleration catch up. Over time, efficiency improvements compound and new business models emerge.

In parallel, a growing ecosystem of AI infrastructure suppliers, including chipmakers, networking providers, and storage companies, offers investors diversified exposure. These companies function as the “pick-and-shovel” layer of the AI economy, benefiting from demand regardless of which platforms ultimately dominate.

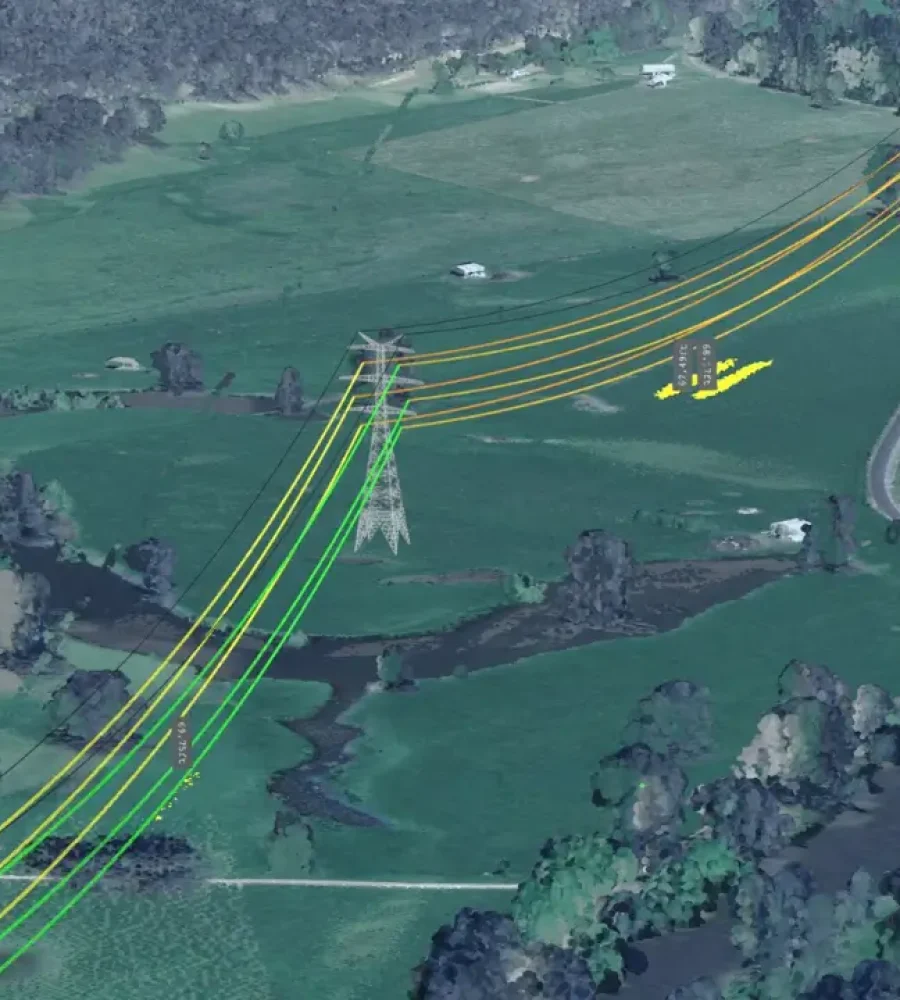

3. Scale and Competitive Advantage Matter

There are reasons why large tech firms are willing to commit so much capital. The barriers to entry, physical data center build-outs, power contracts, and advanced semiconductor access, ensure that only a handful of companies can dominate this space. Investors who believe in network effects and first-mover advantages see this as a moat that will pay dividends over time.

Bullish investors, including some hedge funds, argue that the market has not yet fully priced in the transformative impact of AI on legacy sectors. In their view, faster and broader AI adoption, especially in enterprise settings, will drive multi-year growth that dwarfs the current headline figures.

The Bubble Concerns: When Spending Outpaces Returns

1. Rising Skepticism from Markets

Despite compelling long-term arguments, investor reactions in early 2026 have been mixed. Announcements of elevated capital expenditure have sometimes triggered share price declines, particularly among hyperscalers. Markets appear less willing to reward growth without a clear timeline to returns.

Even companies beating earnings expectations have faced volatility as investors scrutinize how and when infrastructure investments will translate into free cash flow. The market narrative has shifted from growth at any cost to disciplined capital allocation. Extended depreciation schedules and near-term cash flow pressure are becoming focal points of concern.

2. The True Cost of Expansion

Another source of unease lies in the composition of the spending itself. A meaningful portion of CapEx is tied to components such as memory, where price inflation has inflated spending figures without proportionally increasing deployed capacity. In such cases, headline numbers may exaggerate the expansion of actual infrastructure.

At the same time, substantial capital outlays today could suppress free cash flow and earnings metrics for years. When valuations already imply strong future performance, this dynamic leaves little room for execution missteps or slower-than-expected adoption.

3. Broader Market Signals

Caution is not limited to individual companies. Several major financial institutions have flagged capex risk within the broader technology sector. Slowing growth in certain software categories and increased volatility across related stocks suggest that concerns are spreading.

If expectations for AI-driven growth are already embedded in valuations, even modest disappointments could trigger outsized corrections. The bubble thesis, therefore, rests less on the promise of AI itself and more on the possibility that market pricing has outpaced realistic return timelines.

Finding the Middle Ground

Framing the debate as bullish or bubble oversimplifies a complex reality. The scale of AI infrastructure investment in 2026 is historic, yet history shows that transformative technologies often demand enormous upfront capital before rewards materialize. The internet, mobile computing, and cloud computing each endured periods of heavy expenditure before monetization accelerated.

Still, caution is warranted. Capital is finite, technological change is unpredictable, and competitive dynamics can shift rapidly. Investors today stand at the intersection of technological optimism and financial discipline.

For long-term investors with strong conviction in AI’s societal and economic impact, the current build-out may represent infrastructure preceding breakthrough. For shorter-term traders or valuation-sensitive allocators, volatility and the risk of overextension remain real considerations.

What Investors Should Watch

- Earnings Reports and Cash Flow Trends: Track how hyperscalers manage the balance between capital expenditures and sustainable cash flow.

- AI Adoption Metrics: Focus not only on spending levels but on enterprise adoption rates, inference demand, and revenue from AI-enabled products.

- Infrastructure Supply and Demand: Monitor whether capacity constraints ease or intensify as deployments scale.

- Valuation Shifts: Pay attention to how interest rates, macroeconomic conditions, and broader market sentiment influence tech valuations.

AI infrastructure spending in 2026 does not fit neatly into a narrative of reckless speculation or unquestioned optimism. It represents a high-stakes expansion phase that will test both corporate execution and investor patience. The choices made during this period will shape the competitive landscape of technology for years to come.