Europe talks a great deal about artificial intelligence. Leaders promise digital sovereignty, ethical guardrails, and strategic autonomy. Yet behind these goals lies a very physical challenge. The continent’s energy infrastructure is struggling to keep up with the power demands of AI and data centers. Without clearing that bottleneck, Europe risks falling behind the United States and Asia in the global AI race.

AI Needs Power, Not Just Policy

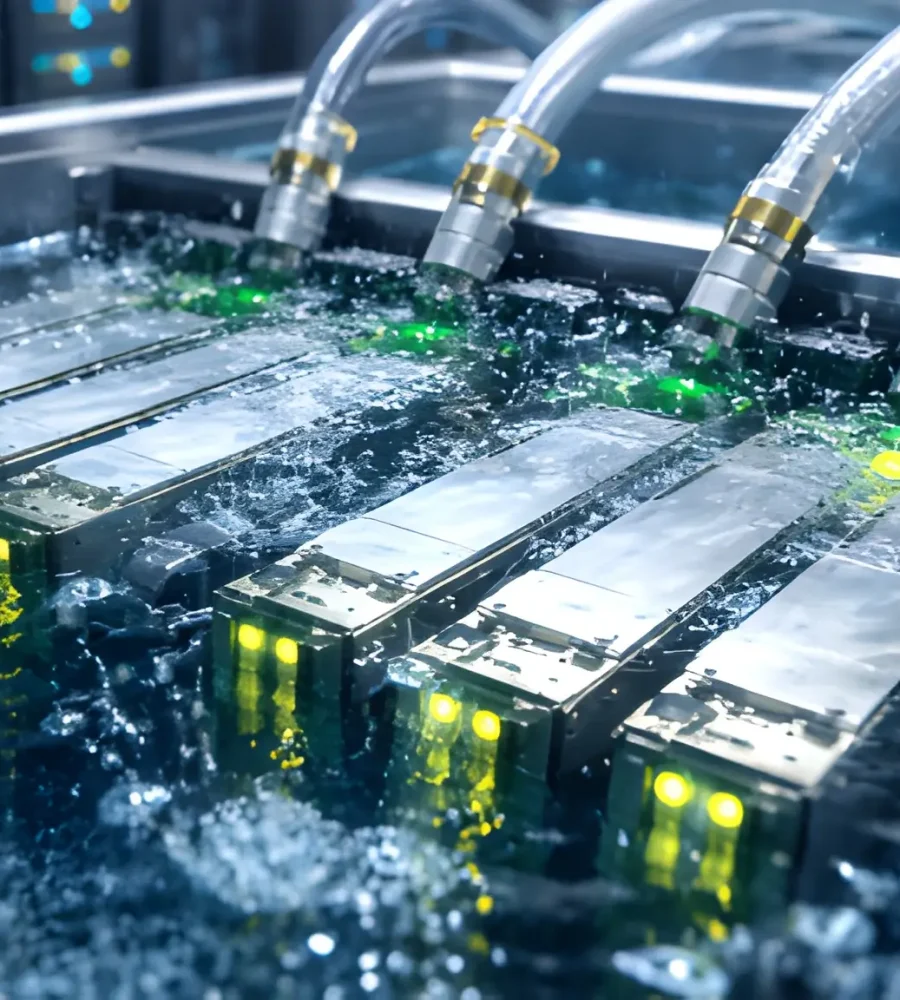

Artificial intelligence depends on electricity. Training large AI models requires massive computing clusters that draw continuous, high levels of power. As AI demand grows, Europe’s grids are showing stress in key markets. In cities like Dublin, Amsterdam, Frankfurt, and London, data centers already consume between 30% and 80% of local electricity demands. In Dublin in particular, data centers could account for nearly a third of national power use by 2026. These realities are not abstract trends. They represent a real limit on the continent’s ability to build more AI infrastructure.

Meanwhile, many governments and regulators focus on data sovereignty and regulatory frameworks rather than the wires, transmission lines, and transformer stations that actually deliver power. That creates a disconnect between policy aspirations and energy realities.

Grid Delays Are Stalling AI Expansion

One of the clearest examples of Europe’s energy bottleneck involves Amazon Web Services (AWS). AWS has warned that securing a grid connection in Europe can take up to seven years, which is far longer than the roughly two years needed to build a data center. These long lead times have already forced cancellations of planned facilities, such as a proposed site in Ballycoolin, Ireland.

The problem is widespread. Major European hubs like Frankfurt, London, Amsterdam and Dublin are experiencing grid congestion. Infrastructure expansion is slow. Permitting, construction, and actual delivery timelines for power equipment routinely stretch into the next decade. That misalignment slows investment and weakens Europe’s competitiveness for next-generation AI facilities.

As a result, some investors are shifting their focus to regions with spare capacity and quicker power access, including parts of southern and northern Europe outside the traditional data center strongholds.

When Limits Become Policy Choices

In Belgium, grid operators are considering policies to limit how much electricity data centers can consume, effectively rationing capacity to protect other industries. The operator Elia has proposed allocating fixed grid capacity to data centers to prevent other sectors from being crowded out. This proposal comes after data center requests shot up nine-fold since 2022 and now exceed planned grid capacities for 2034.

Such measures reveal how policymakers are increasingly forced into reactive, stop-gap solutions instead of building new infrastructure. In Ireland, the government has effectively paused new large data center connections around Dublin until at least 2028 due to grid limits.

Examples of Better Energy-AI Alignment

Not all developments are bleak. Some national strategies show how aligning energy and AI planning can work. In France, for instance, the data center operator Data4 signed a 12-year contract with EDF to secure 40 MW of nuclear-sourced power for its Paris region facilities starting in 2026. EDF is also offering sites adjacent to nuclear plants with immediate high-voltage connections, demonstrating how reliable baseload energy can support digital infrastructure.

Similarly, a major new initiative in Norway shows how abundant clean energy can become a competitive advantage. A partnership between Aker, Nscale and OpenAI is building what is being called Europe’s first AI “gigafactory” in Kvandal, northern Norway. The facility will host up to 100,000 Nvidia GPUs and deliver around 230 MW of renewable power, with plans to expand further. It sits in a region with plentiful hydropower and cool climate, making energy both cheap and abundant.

That project illustrates that where grids are ready and power is reliable, Europe can attract cutting-edge AI infrastructure that supports sovereignty goals. It also shows that strategic energy planning with clear investment incentives can unlock advanced compute capacity.

The U.S. and Asia Take a Different Path

By contrast, the United States and parts of Asia treat energy expansion as central to their AI strategies, not a peripheral issue. In the U.S., policymakers have streamlined grid permitting and welcomed private investment in generation capacity. That has helped reduce delays and support faster scaling of data center grids. Private capital and deregulated markets have moved more quickly to adapt to AI’s power demands.

In Asia, especially China, state-led investments tie large energy projects to national competitiveness. The result is faster build-outs of transmission systems, batteries, and generation that together support rapid industrial and digital growth.

These approaches give U.S. and Asian markets a visible advantage in hosting hyperscale AI infrastructure. Meanwhile, Europe risks being viewed as a tougher, slower market for power-intensive investment.

Economic and Environmental Consequences

Delayed grid expansion carries real consequences. Economically, data center clusters attract talent, research institutions, and supply chain investments. Regions that secure infrastructure can become magnets for AI-driven growth. Regions that do not risk becoming net consumers of AI services rather than producers of them.

Environmentally, slow grid adaptation can backfire on climate goals. When renewable energy capacity is stranded by transmission constraints, clean power sits unused. AI facilities that cannot secure clean grid connections may turn to carbon-intensive backup generation, undercutting decarbonization efforts.

Additionally, if Europe fails to expand its own AI infrastructure, demand will shift toward countries with heavier reliance on fossil fuels or grid mixes less aligned with climate goals.

What Europe Must Do

Europe needs a new energy-AI strategy that goes beyond regulation and hand-wringing. First, grid modernization must become a top priority. Transmission and distribution upgrades require streamlined permitting and financing. Cross-border interconnectors can help balance supply and demand across regions.

Second, targeted reforms should reduce waiting times for grid connections. Policy frameworks can safeguard environmental goals while ensuring predictable timelines for infrastructure build-outs.

Third, Europe should diversify its energy mix for reliable baseload power. Nuclear, large-scale storage and smart grid technologies should all be part of a future-ready system.

Finally, digital and energy strategies must be integrated. AI roadmaps should include clear power projections and tie them directly to infrastructure investments.

Europe has the talent, capital, and policy ambition to be a leader in AI. But …..

Without electricity flowing reliably to compute facilities, Europe will struggle to keep pace with the United States and Asia.

If Europe fails to resolve its energy bottlenecks, it may watch the next wave of innovation occur elsewhere. Yet the continent still has opportunities to chart a different path. By aligning power and AI strategies with decisive action, Europe can convert its clean energy potential into a competitive advantage in the global AI race.