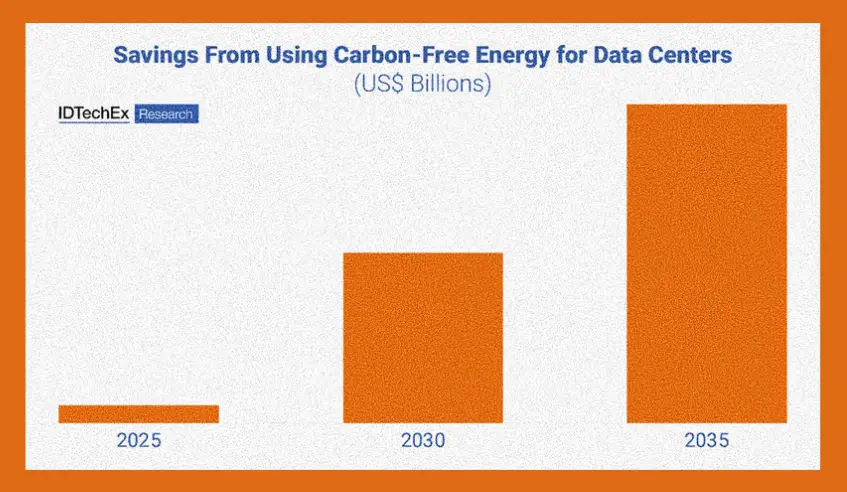

The lower cost of carbon-free energy sources, such as wind and solar, can lead to significant savings for the global data center space compared to a 2024 baseline. Source: IDTechEx.

Today, data centers sip energy- tomorrow, they might guzzle it.

By 2025, data centers will consume just 2% of global electricity (536 TWh), but with the rise of power-hungry generative AI, this could double to 1,065 TWh by 2030. To tackle this, companies are turning to energy-efficient tech and carbon-free power sources.

Eve Pope, Technology Analyst at IDTechEx writes that Data center hyperscalers want new grid capacity added using electricity generation methods that align with their ambitious sustainability goals. Amazon, Microsoft, Meta, and Google are already established as leading corporate wind and solar power buyers globally. Such funding has enabled new wind/solar projects to reach a level of maturity where they are now competitive with fossil fuels.

IDTechEx’s report “Sustainability for Data Centers 2025-2035: Green Technologies, Market Forecasts, and Players”reveals a growing wave of investment in cutting-edge energy solutions— small modular nuclear reactors, hydrogen and fuel cells, enhanced geothermal systems, and grid-scale Li-ion batteries —as data centers seek greener power sources.

Eve highlights the growing momentum behind hourly energy matching for tracking Scope 2 CO₂ emissions, emphasizing the need for stable, carbon-free power sources beyond intermittent wind and solar. While these technologies are currently costlier than fossil fuels, creating demand signals for high-capacity, clean energy generation and storage is key to advancing grid decarbonization.

Although today’s wind and solar projects boast a lower levelized cost of electricity (LCOE) than fossil fuels, this wasn’t the case just a decade ago. For data center hyperscalers willing to invest in sustainable, future-proof operations, early adoption of carbon-free energy could lead to long-term cost savings. IDTechEx projects that by 2035, the global data center industry could save $150 billion by transitioning to low-carbon energy sources instead of relying on fossil fuels (using 2024 as a baseline).

Some emerging energy technologies expected to shape this transition are explored below-

Small modular nuclear reactors

In 2024, data centers reignited interest in nuclear energy, exploring solutions from reviving decommissioned plants and advancing nuclear fusion to backing small modular reactors. Small modular reactors (SMRs) promise cost reductions and shorter construction times relative to their conventional counterparts by taking advantage of assembly line production. However, wider adoption will require technical and regulatory developments, including development in fuel supply chains and international licensing standardization.

Hydrogen and fuel cells

Renewable energy can be converted into hydrogen using electrolyzers and stored for long periods. Fuel cells are advanced energy systems that convert this hydrogen gas back into electricity through a chemical reaction with oxygen. Because solid oxide fuel cells have a long operating lifetime and fuel flexibility, they are well-suited to the continuous power generation required for data centers. Some data centers are already utilizing these solid oxide fuel cells running on natural gas, with plans to transition to low-carbon hydrogen once economic and infrastructure can make this commercially feasible.

Enhanced geothermal

The number of sites suitable for conventional geothermal power plants worldwide is quite limited. However, developing enhanced geothermal technologies could greatly increase the number of viable locations. Both Google and Meta support upcoming enhanced geothermal installations that aim to demonstrate commercial viability, deploying technologies from startups such as Sage Geosystems and Fervo Energy.

Grid-scale Li-ion batteries

Battery energy storage would increase the number of hours per day that data centers can be powered by solar/wind energy. Over the past decade, Li-ion batteries have become an increasingly important stationary energy storage technology suitable for grid-scale applications. When scaling up these technologies, players are prioritizing different performance characteristics such as storage duration or energy density.