The geographic corridor known as Data Center Alley is currently undergoing a massive industrial metamorphosis. This region sits primarily within Loudoun County and the surrounding Northern Virginia landscape. These developments redefine the parameters of mechanical engineering and power distribution. For decades, this region served as the undisputed global headquarters of the internet. It leveraged a historical legacy of fiber optic density. This legacy dates back to early government experiments in wide area networking. However, the industry now faces a sobering new reality in 2026. Traditional models of data center development collide with land scarcity and a constrained electrical grid. Furthermore, the explosive thermal requirements of generative artificial intelligence create new engineering hurdles. These factors have triggered an unprecedented boom in the industrial HVAC sector. Cooling has evolved from a secondary utility into the primary engine of data center profitability.

The Context: Why the Alley is Different

To understand the current HVAC boom, engineers must first appreciate the magnitude of the regional infrastructure. Northern Virginia hosts the largest assemblage of data centers in the world. This region alone accounts for more than 100 of the roughly 500 known hyperscale data centers globally. Specifically, the town of Ashburn serves as the unofficial capital of this Alley. It contains over 150 operational facilities within a small 15 square mile radius. This concentration creates a unique thermal environment. Consequently, data centers no longer function as isolated structures. Instead, they form a continuous industrial ecosystem. These facilities share a common atmosphere and a unified electrical grid.

Defining the Digital Mecca

Local leaders often noted that approximately 70 percent of world internet traffic flows through Loudoun County. Modern analysis suggests this figure may be high. International internet capacity connecting to the United States is actually closer to 23 percent. Nevertheless, the functional reality for mechanical engineers remains the same. The Alley is the primary meeting place for global digital interconnectivity. The financial intensity of this development reflects its importance. In 2025, private companies spent roughly 40 billion dollars per month on data center construction in the United States. This represents a massive increase from the 1.8 billion dollars spent just one decade ago.

The 2026 Power Wall: From Growth to Constraint

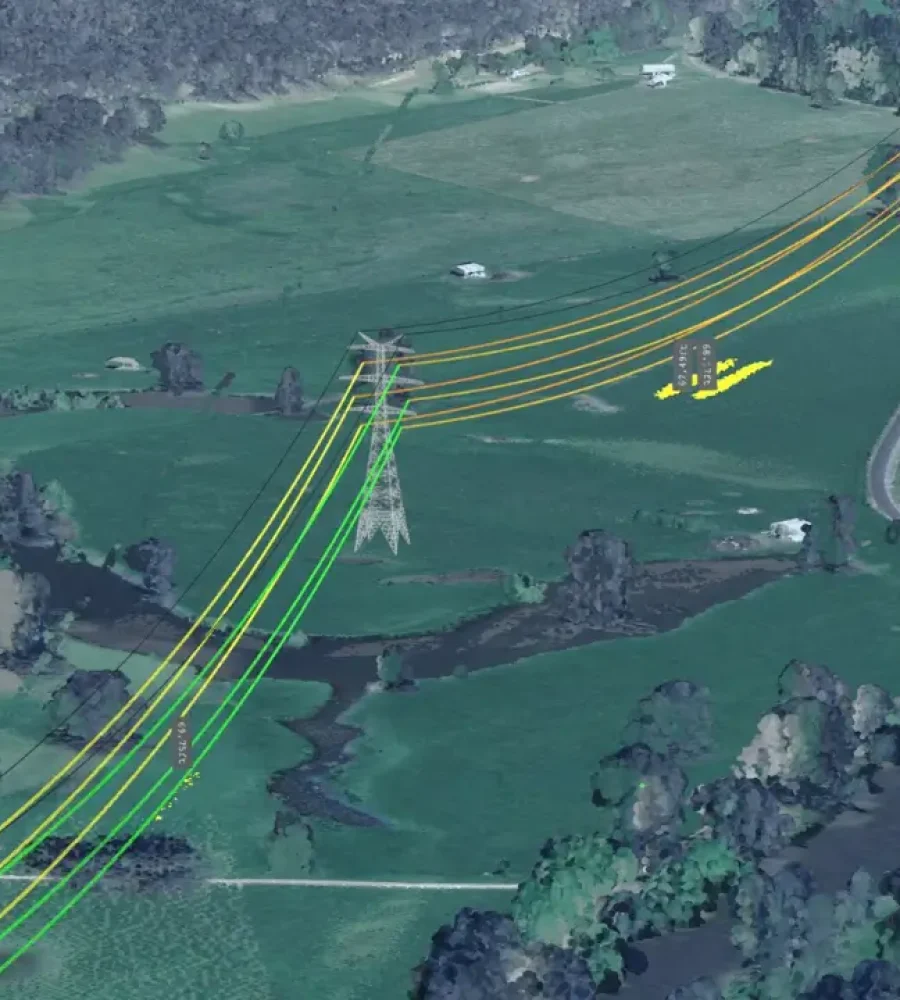

The most significant shift in the development trajectory of the Alley is the transition toward power limitations. The Power Wall of 2026 refers to the point where utility infrastructure fails to keep pace with demand. Artificial intelligence drives this exponential growth in electricity needs. Loudoun County power consumption was roughly 1 GW in 2018. By 2024, this figure rose to over 4 GW. This represents a 176 percent increase from 2019 levels. Projections indicate that the county will require an additional 8.19 GW soon. This brings total projected demand to over 11.5 GW by 2028.

Dominion Energy and PJM Interconnection are currently racing to upgrade the regional grid. They must prevent widespread reliability violations. PJM noted that the area faces a high risk of load loss without immediate transmission reinforcement. Consequently, these constraints have fundamentally altered the HVAC industry. When power is limited, cooling efficiency determines server capacity. Every kilowatt saved by an efficient HVAC system allows for more high value AI compute.

The current state of power in the Alley includes the following milestones:

- Total Power Demand: Consumption grew from 1.0 GW in 2018 to 4.14 GW in 2024, with projections of 11.59 GW by 2028.

- Potential AI Demand: Total potential demand could skyrocket to 30.0 GW by 2029 if current AI trends continue.

- Average Rack Density: Traditional designs focused on 10 to 14 kW, but new deployments frequently exceed 100 kW per rack.

- Grid Wait Times: Timelines for power connections grew from 1 year to a current average of 4 to 7 years.

Vertical Construction: Density Over Footprint

Scarcity and land costs in Ashburn and Sterling have forced a radical change in architecture. Land once available for small sums now costs between 2 million and 3 million dollars per acre. This economic reality makes traditional single story warehouses obsolete. Consequently, developers now build up rather than out. This results in three story facilities that present massive vertical HVAC challenges.

The Vertical Pumping Challenge

Vertical construction complicates the process of heat rejection. In a horizontal facility, engineers vent heat through the roof with simple airflow management. In a three story building, mechanical systems must transport heat through complex vertical risers. They move this heat to roof mounted chillers or cooling towers. This creates significant pumping head requirements. Furthermore, it increases the risk of thermal recirculation. Hot exhaust from lower floors can return to the intakes of upper floors. The structural weight of liquid cooling loops also places stress on multi story steel frames.

The AI Inflection Point: 10kW to 100kW Plus

Artificial intelligence serves as the core narrative engine for the current HVAC boom. Generative AI thermal demands differ fundamentally from traditional cloud computing. A standard rack in the Alley historically supported 10 kW to 14 kW of power. However, the newest GPU clusters push densities to 100 kW and beyond. Specifically, the NVIDIA Blackwell architecture demands intense thermal management.

The Death of Air-Only Cooling

The jump to 100 kW per rack has effectively ended the era of air only cooling for high performance halls. Traditional Computer Room Air Conditioners rely on massive air volumes to remove heat. However, air is an inefficient thermal conductor. At densities above 20 kW per rack, fan power becomes prohibitively expensive. It is physically impossible to move enough air through a standard server chassis at these levels.

Implementing Liquid-to-Chip Solutions

The industry is currently navigating a phased transition to liquid cooling technologies. These methods include:

- Traditional Air and Aisle Containment: This method supports densities up to 20 kW and features low initial costs.

- Rear Door Heat Exchangers (RDHx): These radiators attach to the back of the rack to capture exhaust air. They support loads up to 40 kW.

- Single Phase Direct to Chip (DTC): Coolant circulates through a cold plate on the GPU. This is the current sweet spot for AI between 50 kW and 200 kW.

- Two Phase Direct to Chip Cooling: This method uses the latent heat of vaporization of a refrigerant. It is the most efficient method for future megawatt class racks.

- Immersion Cooling: This approach involves submerging servers in dielectric fluid. It handles densities over 100 kW and eliminates server fans.

Retrofit vs. Greenfield: Mechanical Modernization

A significant portion of the boom comes from the modernization of legacy facilities. These older data centers were built in the early 2010s. They were designed for low density air cooling. Consequently, they lack the plumbing infrastructure required for AI chips. Industrial HVAC contractors now secure massive contracts for live retrofits. They replace cooling systems while the data center remains operational. These mechanical upgrades often cost between 150,000 and 500,000 dollars per facility.

The Industrial Supply Chain and Labor Crisis

The technical evolution of the Alley faces obstacles from a global supply chain crisis. Furthermore, a domestic shortage of specialized labor creates recruitment battles. Project managers in Northern Virginia must view the boom as a fight for logistics and talent.

Equipment Lead Times and Procurement Strategies

Demand for industrial cooling equipment far outpaces current manufacturing capacity. Lead times for critical components have stretched to extreme levels. The current state of procurement involves the following timelines:

- Industrial Chillers: Lead times now exceed 50 weeks. This is a sharp increase from 16 weeks before the pandemic.

- Cooling Distribution Units (CDUs): Wait times range from 20 to 26 weeks. Variable speed pumps act as the primary bottleneck.

- Diesel Backup Generators: These units face extreme delays of 72 to 104 plus weeks.

- Precision Heat Exchangers: Procurement takes 30 to 40 weeks due to specialized metallurgy requirements.

Project managers navigate these delays through advance procurement. They purchase equipment years before they secure a site. Furthermore, firms use prefabricated modular cooling skids. These units are tested in factories before they ship to the Alley for deployment.

The Skilled Labor Gap: Wet vs. Dry Expertise

Loudoun County has become a war zone for mechanical talent. The HVAC industry faces a national shortage of roughly 110,000 technicians. This gap may reach 225,000 by 2027. In Northern Virginia, the shortage is acute for technicians who understand both wet and dry systems.

- Wet Systems: These involve plumbing and hydronics for liquid cooling loops. Technicians must master high pressure piping.

- Dry Systems: These encompass electrical controls and building management systems.

This shortage leads to aggressive poaching between firms. Experienced technicians now command salaries previously reserved for senior engineers. Northern Virginia Community College has expanded its Air Conditioning and Refrigeration programs. They now include certifications in Data Center Operations to fill the pipeline.

Community and Environmental Friction

In the Alley, HVAC is no longer just a technical issue. It has become a central point of political friction. Data centers have moved closer to residential neighborhoods in areas like Great Falls and Haymarket. Consequently, residents now place mechanical systems under intense scrutiny.

The Noise Wars: Acoustic Litigation

Noise serves as the most visceral point of conflict. Residents have mobilized against the hum from external chiller plants and fan banks. This noise is often tonal and constant. It penetrates walls more effectively than traffic noise. Specifically, the Haymarket Hum has led to a rise in private nuisance litigation.

Attorneys in the region now deploy acoustic engineers. They monitor decibel levels to prove that data centers interfere with the quiet enjoyment of property. Consequently, developers must invest in acoustic dampening. They build massive sound walls and baffles. Furthermore, some operators use quiet mode HVAC systems. These adjust fan speeds during nighttime hours to meet noise ordinances.

Navigating Water Usage Effectiveness (WUE)

Loudoun County is also scrutinizing water consumption. Different cooling strategies have varying environmental impacts:

- Potable Water: A medium facility can consume 100 million gallons annually. Regulators are increasingly restricting this method.

- Reclaimed Water: This method recycles effluent and creates low stress on the utility. Local governments actively encourage it.

- Closed Loop Systems: These systems reuse water indefinitely. They have a negligible impact on local supplies and are preferred for new builds.

- Air Cooled Systems: These use zero water. Communities favor them, but they can lose efficiency during summer heat.

The industry average WUE is currently 1.8 liters per kWh. However, top tier designs in the Alley aim for WUE levels near zero.

Emerging Technology Hotspots

As the industry looks toward 2030, emerging technology hotspots define the future. These innovations solve the twin challenges of power constraints and environmental impact.

Liquid-to-Liquid CDUs: The Critical Interface

The Coolant Distribution Unit is the critical interface in a modern AI data center. It acts as the bridge between the facility water loop and the server liquid loop. Specifically, liquid to liquid CDUs are the premium market segment. They offer superior heat dissipation efficiency compared to liquid to air models. Furthermore, vendors now equip these units with IoT sensors. These provide real time analytics to detect small pressure drops and potential leaks.

Heat Reuse and District Heating Models

The practice of using waste heat for municipal purposes is entering the local conversation. Approximately 81 percent of electricity consumed by a data center becomes usable waste heat. Consequently, active legislative proposals like Virginia House Bill 323 identify opportunities for recovery. Potential applications include:

- District Heating: Capturing warm water from loops to heat residential buildings or campuses.

- Agricultural Use: Using waste heat to maintain greenhouse temperatures.

- Solar Thermal Boosting: Rice University research suggests using solar collectors to raise waste heat temperatures. This allows for clean electricity generation via an Organic Rankine Cycle.

AI-Managed HVAC Software Systems

Perhaps the most ironic development is the use of AI to cool AI. Traditional mechanical controls struggle with the dynamic environment of a modern facility. Google’s DeepMind team pioneered machine learning to optimize cooling. This reduced cooling energy consumption by 40 percent. In the Alley, these software platforms are now a competitive necessity. AI agents gather sensor readings every few minutes. They predict facility temperatures over the next hour and adjust chiller speeds proactively.

The Road Ahead for Data Center Alley

The industrial HVAC boom in Northern Virginia reflects a maturing industry. The era of the simple data center is over. In its place is a complex industrial facility. This facility must function as a good neighbor and a power efficiency paragon. For mechanical contractors, the Alley remains the ultimate testing ground. Specifically, the solutions developed here for the 2026 AI surge will become global blueprints.