The data center industry is undergoing a fundamental shift in how development logic is conceptualized as infrastructure-driven data center expansion replaces traditional land-centric approaches as the primary determinant of viability. In the past, site selection and project valuation hinged on real estate metrics such as location, price per square foot, and zoning flexibility, but those criteria are now subordinate to the availability of critical infrastructure inputs like power capacity, grid connectivity, and network bandwidth. Industry executives and analysts assert that expansion logic now begins with securing electrical capacity and utility commitments long before land acquisition takes place, effectively reversing decades of conventional development sequencing.

This evolution reflects the imperative of serving high-density computing workloads, especially artificial intelligence and cloud services, which require sustained high-power delivery and low-latency connectivity. Developers increasingly regard land simply as an attachment to a viable infrastructure backbone rather than the core asset itself, as the presence of deliverable power and fiber has become more predictive of project success. Consequently, infrastructure-driven data center expansion is shaping where and how the next generation of digital infrastructure will be built, with implications for investors, utilities, and policymakers alike.

The Shift from Real Estate to Infrastructure as the Primary Driver

The traditional real estate paradigm for data center development prioritized land availability, proximity to major markets, and fiber connectivity as the first filters in site selection. In that model, developers would secure acreage near urban centers, assess fiber and transport links, and then layer power requirements as part of the build-out sequence. Today, that sequence has been inverted in many markets as power availability has emerged as the gating factor for project viability, superseding other locational attributes.

Analysts highlight that with the surge in demand from hyperscale computing and AI workloads, data centers have intensified focus on securing utility commitments and grid capacity before any substantive design or land commitment occurs. This shift is evident in markets where land exists in abundance but cannot support high-density electrical loads within the necessary timelines, leading to stalled projects and reconfigured site strategies. As a result, developers and institutional investors alike now prioritize sites with pre-secured infrastructure entitlements as part of their risk mitigation and strategic planning frameworks.

Infrastructure Bottlenecks as the Primary Constraint

In several regions facing power constraints, delayed grid connections are cited as the primary bottleneck impeding data center expansion even when real estate is readily available and affordable. For example, hyperscale operators have publicly acknowledged that utility interconnection timelines that extend multiple years can derail development plans and force cancellations of planned facilities. This illustrates the degree to which power, not land, now defines project timelines and feasibility, with utilities acting as de facto gatekeepers of expansion.

The industry is responding by reengineering site selection criteria to include proximity to transmission corridors, available substation capacity, and renewable energy sources, which together form the backbone of modern digital infrastructure. These factors increasingly outweigh traditional real estate considerations such as zoning flexibility or distance to urban centers in determining project viability. The consequence is a reorientation of development logic toward infrastructure assets and away from classic property metrics.

Infrastructure Bottlenecks Are the New Limiting Factor

Institutional capital flows reflect this strategic realignment as investors incorporate infrastructure risk profiles into underwriting models rather than relying solely on land valuations. Investment vehicles have shifted toward prioritizing secured power capacity and long-term utility contracts as essential elements of transaction due diligence. These changes reflect a broader recognition that the variable driving future returns is the ability to deliver continuous, scalable power rather than the mere possession of land parcels. In many transactions, power purchase agreements and infrastructure readiness assessments have become core to asset valuation, signaling a departure from traditional real estate valuation heuristics. Industry reports note that land with pre-secured utility commitments often commands a premium due to its reduced execution risk and accelerated development timelines. This trend underscores the growing consensus that infrastructure readiness is now the leading indicator of data center project success.

Responding to these market dynamics, some data center developers now design facilities around the power delivery topology rather than customizing power infrastructure to fit predefined building footprints. In practice, this means that architectural layouts and campus master plans are increasingly shaped by electrical substations, transmission routes, and redundancy pathways before construction begins.

Designing Facilities Around Power and Connectivity

Industry stakeholders emphasize that while land remains an essential component of data center development, its role has become subordinate to the infrastructure on which it depends, particularly electrical and connectivity frameworks. This is especially true in emerging markets where grid capacity and fiber infrastructure are still evolving, and where developers must invest in extending or upgrading utilities as part of project budgets. As such, the cost and lead time associated with infrastructure deployment increasingly determine where and how data centers are placed, reshaping geographic patterns of expansion.

Secondary markets that once lagged have become more attractive due to proximity to transmission assets or renewable energy resources, even if those locales present less conventional real estate appeal. Consequently, traditional real estate hubs are encountering competition from regions that were previously overlooked but now offer superior infrastructure alignment. The net effect is a redistribution of data center growth corridors aligned with infrastructure potential rather than historical land market dynamics.

Redefining Site Selection Criteria in an Infrastructure-Centric Era

In the contemporary landscape, effective site selection begins with an assessment of the electrical grid’s capacity to support anticipated loads and redundant pathways necessary for uninterrupted operations. Location analysis now incorporates detailed evaluations of power headroom, substation adjacency, and developer utility relations as primary filters in early-stage feasibility studies. These infrastructure-focused metrics are increasingly predictive of project timelines and risk profiles, and they often supersede conventional property evaluation criteria.

Developers are routinely investing in multi-feed architectures, dedicated substations, and redundant transmission linkages before finalizing land purchases or designs. This reflects a strategic imperative to secure dependable energy delivery for high-density computing environments that traditional land-centric models no longer address. The elevated importance of infrastructure access has led to a shift in how communities and local governments compete to attract data center investment, emphasizing grid modernization and streamlined permitting processes.

Infrastructure-First Approaches Reshape Community Engagement

The implications of this shift extend to the financing structures underpinning data center projects, with lenders and equity partners demanding rigorous infrastructure risk assessments and mitigation strategies prior to committing capital. Financial due diligence increasingly centers on utility interconnection agreements, grid stability forecasts, and the presence of scalable power infrastructure as conditions precedent for funding. This trend is evident in joint ventures and investment mandates that explicitly integrate infrastructure readiness metrics into capital deployment criteria. In several recent large-scale partnerships, infrastructure capability formed the basis for investment decisions rather than land value or speculative rent growth assumptions. As power constraints have tightened in established markets, alternative regions with robust infrastructure backbones have attracted institutional capital seeking to de-risk portfolios while ensuring long-term operational viability. These developments underscore the maturation of data centers as infrastructure assets rather than conventional property plays.

The transformation in site selection logic also catalyzes changes in how communities engage with data center proponents, with economic development agencies focusing on utility readiness and infrastructure incentives as primary competitive advantages. Municipalities seeking to attract digital infrastructure investment increasingly highlight grid modernization initiatives, high-capacity fiber routes, and streamlined permitting for power-related construction as part of their value propositions.

This reflects a broader recognition that data center projects deliver long-term economic benefits but require significant upfront investment in connective infrastructure. In response, some jurisdictions have established utility partnership frameworks to accelerate permitting and grid upgrades, recognizing that these measures directly influence the likelihood of development commitments. Furthermore, regional power planning agencies are beginning to incorporate data center load forecasts into broader transmission build-out strategies, acknowledging their role as anchor consumers shaping grid evolution. These shifts illustrate the escalating importance of infrastructure alignment in local competitiveness for data center growth.

Emerging Challenges in Infrastructure-Driven Expansion

Data center operators face a growing set of challenges as they pivot to infrastructure-centric expansion models. Electrical grid congestion, long lead times for substation upgrades, and utility interconnection delays create uncertainty that can stall or even cancel projects despite favorable land conditions. Planners emphasize that high-density facilities consume power at scales previously unimaginable, and grid operators must recalibrate distribution and transmission planning to accommodate these new loads.

Moreover, renewable energy integration introduces complexity, as intermittent generation must be balanced against continuous load demands, prompting sophisticated energy storage and demand response strategies. Developers are also increasingly attentive to regulatory frameworks that influence permitting timelines, interconnection fees, and environmental compliance obligations. These constraints collectively force an operational mindset where infrastructure feasibility dictates the speed, scale, and location of expansion.

Compounding these technical issues, regional disparities in utility capacity and regulatory approaches significantly affect project economics and timelines. Markets with underdeveloped grid infrastructure often require developers to invest in dedicated substations or energy microgrids, raising capital intensity and project complexity. Conversely, regions with mature infrastructure and streamlined regulatory regimes facilitate faster deployment and lower execution risk, thereby attracting premium investment attention. Data center operators report that balancing high-density load requirements with available infrastructure has become the dominant factor in site selection, surpassing considerations such as real estate price or proximity to end users. These conditions necessitate multi-disciplinary planning teams capable of integrating electrical engineering, mechanical design, regulatory compliance, and real estate strategy. Transitioning from a land-first to infrastructure-first model requires not only capital allocation but also organizational adaptation, highlighting a shift in both mindset and operational workflow.

Power Availability as the New Competitive Advantage

The industry increasingly regards access to reliable, scalable power as the ultimate competitive differentiator. Operators assert that without guaranteed delivery of high-capacity electricity, other site attributes, including land and fiber proximity, offer limited strategic value. Utility engagement and early power commitment negotiations now dominate pre-development phases, influencing both project sequencing and investment prioritization. Advanced operators also evaluate energy sourcing, such as renewable integration and local generation capacity, to enhance resilience and meet corporate sustainability commitments.

In this environment, securing infrastructure entitlements often dictates the difference between projects that proceed on schedule and those that stagnate indefinitely. Consequently, power availability has emerged as both a risk management tool and a strategic lever for accelerating market entry, demonstrating that infrastructure readiness is inseparable from long-term operational success.

Industry participants report that regions with abundant, high-quality grid connections increasingly attract hyperscale operators, while constrained markets struggle to retain existing facilities or encourage expansion. This has led to a reevaluation of traditional data center clusters and a diversification of geographic investment strategies. Developers are not merely seeking land parcels; they are targeting electrical corridors, substation adjacencies, and low-latency fiber convergence points as primary site attributes. As a result, previously overlooked secondary markets are gaining strategic importance, attracting developers who can leverage infrastructure availability for faster deployment. Analysts note that this shift has accelerated infrastructure investment cycles, with utilities now collaborating with developers to anticipate load growth and enhance capacity planning. Such coordination illustrates the increasingly symbiotic relationship between digital infrastructure operators and utility providers.

The Role of Renewable Energy and Grid Modernization

Sustainability imperatives have intensified the need for modernized, resilient grids capable of supporting high-density data center loads. Operators are actively integrating renewable energy sources, energy storage solutions, and demand management protocols to meet sustainability goals while ensuring uninterrupted power delivery. Grid modernization, including advanced transmission management and digital monitoring systems, enables operators to optimize energy flows, reduce risk of outages, and maintain operational continuity. In practice, renewable integration challenges traditional supply paradigms by introducing intermittency, which requires sophisticated balancing mechanisms such as co-located storage or flexible load management. These innovations, while technically complex, are now essential for infrastructure-driven data center development strategies. The interplay between renewable adoption and infrastructure readiness has redefined development priorities, with energy availability and resilience now taking precedence over land-centric valuation models.

Developers are increasingly collaborating with utilities to ensure that power sourced from renewable infrastructure meets strict reliability standards. Energy procurement strategies often incorporate hybrid approaches, combining on-site generation, off-site renewable contracts, and storage-enabled backup systems to mitigate supply volatility. The integration of these systems also necessitates careful engineering to balance load demands, cooling requirements, and energy distribution across data center campuses.

Consequently, operational planning has become a multi-faceted process where land plays a supporting rather than leading role in determining project success. Utilities, in turn, benefit from predictable, high-capacity demand that justifies infrastructure upgrades and grid resilience investments. These partnerships demonstrate the growing interdependence between infrastructure availability and operational viability, reinforcing the notion that modern data center expansion is an infrastructure-first endeavor.

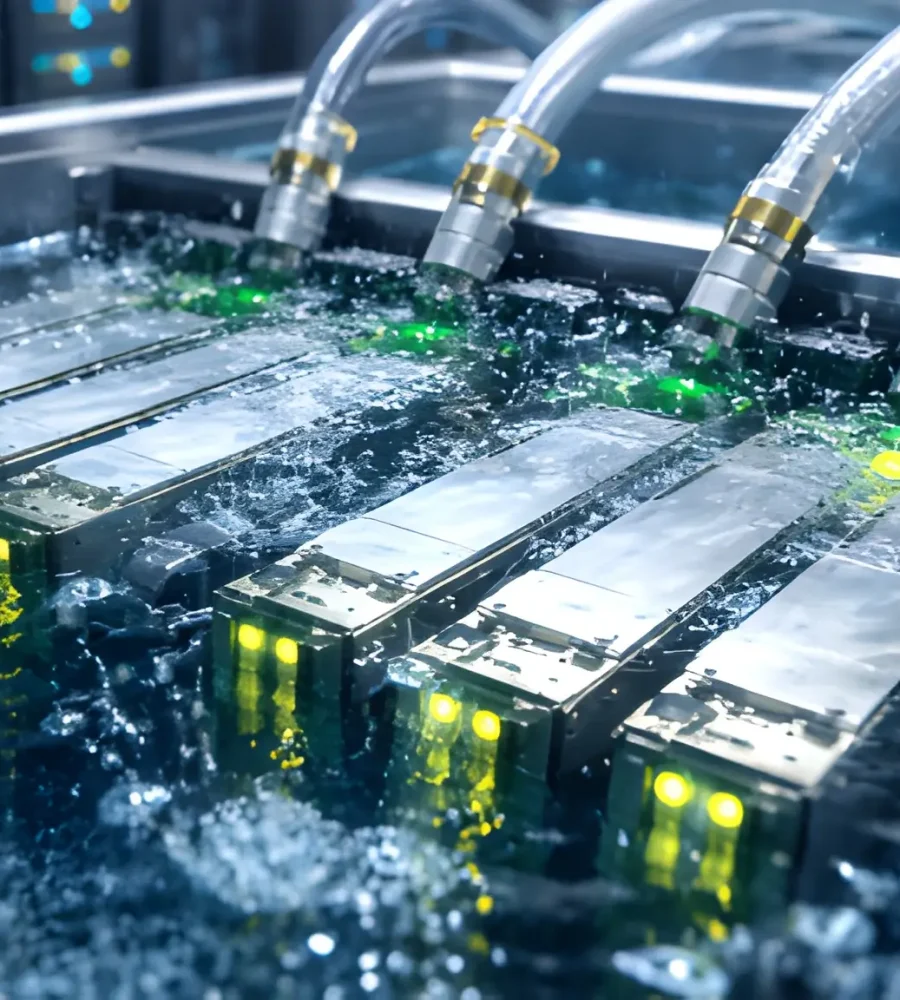

Cooling and Mechanical Systems Aligned with Infrastructure

As electrical loads increase, the design of cooling and mechanical systems must align tightly with available infrastructure capacity. High-density deployments, particularly those supporting AI workloads, generate concentrated thermal output that demands precise engineering of HVAC systems, liquid cooling loops, and redundancy configurations. Developers now approach cooling design after confirming power availability, ensuring that thermal management solutions can operate efficiently within the constraints of electrical supply.

This sequencing contrasts sharply with older models, where cooling systems were often retrofitted or scaled independently of primary utility considerations. By integrating power and cooling strategies from the outset, operators achieve higher operational efficiency, reduced downtime risk, and predictable performance metrics. In essence, the infrastructure-first approach has redefined the interplay between electrical and mechanical systems, making them mutually dependent for optimal facility operation.

Mechanical infrastructure planning also incorporates resilience measures such as N+1 redundancy, failover pathways, and cross-campus energy balancing to ensure continuity during peak loads or component failures. Engineers simulate electrical and thermal demand scenarios to optimize equipment placement, airflow distribution, and load-sharing mechanisms. Consequently, the physical footprint of the data center becomes a function of infrastructure design rather than a fixed land template. Developers increasingly leverage modularity in mechanical systems, allowing phased deployment that aligns with staged infrastructure availability. This iterative approach permits operators to scale facilities efficiently while mitigating upfront capital expenditure risks. Overall, infrastructure-aligned mechanical planning reflects a profound departure from land-centric assumptions, emphasizing performance reliability as a primary driver of facility configuration.

Fiber, Latency, and Network Considerations

In addition to power, network connectivity and fiber infrastructure have become pivotal in shaping site selection for modern data centers. High-speed, low-latency fiber access is essential for hyperscale cloud operations, AI inference workloads, and enterprise colocation services. Developers prioritize locations with multiple fiber paths and the ability to deploy redundant network links without lengthy construction approvals. Transitioning from land-focused development, operators now view fiber accessibility as an extension of infrastructure readiness rather than an ancillary utility. Sites with underdeveloped fiber availability are often deprioritized, regardless of their geographic desirability or land cost advantages.

Strategic fiber placement enhances resilience, reduces latency, and ensures service continuity, particularly for latency-sensitive applications such as financial trading, content delivery, and AI-driven analytics. Consequently, fiber infrastructure has become a core criterion in infrastructure-driven data center expansion.Network integration planning now occurs concurrently with power and cooling design to ensure alignment across all infrastructure domains. Developers conduct thorough assessments of fiber providers, route diversity, and interconnection points to minimize single points of failure.

This integrated approach supports high-availability architectures, enabling seamless load balancing and disaster recovery capabilities. By treating fiber as a strategic infrastructure asset, operators enhance operational predictability while mitigating long-term risk. Additionally, proximity to carrier hotels, internet exchange points, and peering locations informs site feasibility assessments, effectively shifting decision-making toward a multi-layered infrastructure framework. The emphasis on connectivity, when combined with power and mechanical alignment, illustrates how infrastructure considerations collectively redefine expansion priorities.

Land as a Supporting, Not Leading, Factor

Although land remains essential, its role in modern data center development has become supportive rather than determinant. Sites are now evaluated primarily for their ability to accommodate infrastructure requirements rather than for inherent real estate value. Developers often select parcels that may be unconventional from a traditional property perspective but offer optimal alignment with power, fiber, and regulatory parameters. This reversal signifies a broader shift in strategic priorities, where infrastructure feasibility dictates project sequence, sizing, and phasing. Land acquisition strategies now integrate contingency planning for potential future infrastructure upgrades, reflecting the uncertainty of evolving utility landscapes. In practice, successful site selection relies on an orchestrated evaluation of electrical, cooling, and connectivity readiness first, followed by land fitment considerations.

Secondary market emergence exemplifies this phenomenon, with developers targeting regions previously overlooked due to perceived land scarcity or logistical limitations. When these sites provide superior infrastructure accessibility, they often surpass traditional metropolitan centers in strategic attractiveness. Developers report that real estate transactions increasingly reflect this shift, with land being appraised primarily as a vessel for infrastructure deployment rather than as a stand-alone asset. Municipalities aiming to attract investment are consequently adjusting zoning, permitting, and utility incentives to prioritize infrastructure readiness over land value. This paradigm shift underscores the central thesis: in contemporary data center expansion, land is a supporting enabler, whereas infrastructure is the decisive driver.

Regulatory and Permitting Implications

Infrastructure-driven expansion has fundamentally altered the interface between data center developers and regulatory authorities. Local, state, and federal permitting processes now emphasize utility integration, environmental compliance, and resilience planning more than traditional land-use approvals. Developers engage regulators early to secure electrical permits, substation enhancements, and transmission agreements, ensuring that infrastructure commitments precede construction. This proactive approach reduces the risk of delays and aligns with operational timelines dictated by client requirements.

Moreover, agencies are increasingly asked to facilitate renewable energy integration, stormwater management, and mechanical system compliance as part of infrastructure readiness assessments. The result is a collaborative framework where regulatory processes are synchronized with technical and operational planning rather than treating infrastructure as an afterthought. Developers note that these regulatory dynamics significantly impact project economics, as permitting timelines and associated compliance costs can alter capital allocation and investment prioritization. Jurisdictions that streamline infrastructure-related approvals attract disproportionate investment, reinforcing the link between infrastructure readiness and economic competitiveness.

Conversely, regions with fragmented or delayed permitting processes encounter reduced developer interest despite available land. Strategic planning now incorporates detailed regulatory roadmaps, infrastructure risk assessments, and contingency pathways to ensure timely project execution. By embedding regulatory considerations into infrastructure-first planning, operators achieve operational predictability and reduce execution risk. This evolution further demonstrates the subordinate role of land in modern data center site selection, where legal and utility approvals now lead development sequencing.

Financing and Capital Allocation Shifts

Infrastructure-driven development has also transformed financial structuring and capital allocation for data center projects. Lenders and equity investors increasingly evaluate power commitments, substation access, and network connectivity as primary risk determinants. Land value, previously a central consideration, is now largely factored as a secondary variable once infrastructure feasibility is confirmed. Consequently, financing models now integrate detailed infrastructure readiness audits, long-term utility agreements, and contingency planning into underwriting assumptions.

Investment committees prioritize capital deployment toward projects with verified power availability and network resilience rather than speculative real estate acquisitions. This shift has led to a rebalancing of investment strategies, with capital increasingly flowing to regions offering superior infrastructure alignment rather than traditional metropolitan hubs.

Multi-phase development strategies are often employed to align infrastructure deployment with funding tranches, optimizing both capital efficiency and risk mitigation. As a result, infrastructure readiness directly correlates with investor confidence, influencing both equity and debt terms. Investors are increasingly sophisticated in modeling energy load, redundancy, and latency impacts on projected revenues, demonstrating the centrality of infrastructure in valuation and risk assessment. This evolution signals a fundamental departure from property-centric financial models, reflecting the maturation of data centers as complex infrastructure assets rather than simple real estate holdings.

Technological Innovations Driving Infrastructure Dependency

Technological advances have further cemented infrastructure as the leading determinant of site selection. Emerging high-performance computing, AI inference workloads, and hyperscale cloud deployments impose unprecedented demands on power, cooling, and network systems. Legacy land-centric strategies cannot accommodate the density, redundancy, and operational resilience required by modern workloads. These approaches demonstrate that physical land footprints are secondary considerations in strategic planning. Operational efficiency, reliability, and scalability now derive from infrastructure alignment rather than spatial extent, illustrating a paradigm shift in engineering and deployment methodology.

Integration of emerging technologies such as AI-driven load balancing, predictive maintenance, and energy optimization platforms further amplifies infrastructure reliance. These systems dynamically manage power, cooling, and network resources in real time, making infrastructure capability the gating factor for operational success. Land attributes, while necessary, play a subordinate role once infrastructure parameters are satisfied. Industry leaders highlight that future-proofing data centers increasingly depends on embedding advanced technology into infrastructure planning, reinforcing the centrality of power, connectivity, and mechanical systems. Consequently, infrastructure-first development models not only enhance operational reliability but also enable technological agility, providing a competitive advantage in a rapidly evolving market landscape.

Operational Resilience and Redundancy Planning

Infrastructure-driven data center expansion has elevated operational resilience from a secondary consideration to a primary determinant in development strategy. Developers now prioritize redundancy at every layer, including dual-fed power lines, backup generators, mirrored cooling systems, and multiple network entry points. These measures ensure continuous uptime even under extreme conditions, aligning with enterprise clients’ high availability requirements.

Land availability remains necessary to accommodate physical layouts, but the sequencing of redundancy planning begins with infrastructure feasibility, not spatial constraints. Operators increasingly simulate failure scenarios to test the robustness of their designs, integrating insights from power and network analytics to refine contingency strategies. This proactive approach mitigates operational risk while enhancing long-term reliability, reinforcing the infrastructure-first paradigm.

Redundancy planning also influences capital allocation, as investors assess the ability of infrastructure systems to support continuous operations under peak demand and contingency scenarios. Sites with pre-configured infrastructure redundancy command greater investor confidence, while locations requiring extensive upgrades are often deprioritized. Developers now incorporate phased redundancy build-outs into project schedules, ensuring that incremental expansions do not compromise reliability. The operational benefits of infrastructure-aligned redundancy extend beyond uptime, enabling efficient load management, thermal distribution, and energy utilization. By contrast, traditional land-first development models rarely accounted for such complexity at the planning stage. The resulting industry consensus confirms that infrastructure robustness is now a core criterion for successful data center deployment.

Workforce and Talent Implications

Infrastructure-driven development also changes workforce planning and talent needs. Engineers, technicians, and planners must understand electrical systems, mechanical design, network architecture, and regulations. Cross-disciplinary teams manage the complexity of infrastructure-focused projects. Land and site specialists remain relevant but in supporting roles. Training programs now emphasize predictive maintenance, AI energy management, and operational analytics. Staff must respond quickly to electrical anomalies, cooling issues, and network disruptions. Workforce planning now centers on infrastructure complexity rather than facility size. Collaboration with utilities and technology partners requires strong communication and project management skills. Aligning human capital with infrastructure priorities ensures facilities meet performance and reliability standards.

Geopolitical and Market Dynamics

Infrastructure-driven site selection is strongly influenced by geopolitical and market factors. Regions with stable regulation, reliable utilities, and mature connectivity attract more investment. Conversely, areas with unstable grids or unclear policies grow slowly. These conditions shape planning and risk mitigation. Markets once guided by land availability now face competition from regions offering better infrastructure. Infrastructure maturity affects market liquidity and exit potential for assets. Areas with slow network deployment or constrained power experience delays and cost overruns. Strong infrastructure regions provide predictable timelines and operational performance. Capital is increasingly allocated to areas with modern grids, diverse connectivity, and supportive policies. Alignment of infrastructure and market intelligence further reduces the primacy of land.

Future-Proofing Through Infrastructure Alignment

Developers increasingly view infrastructure readiness as essential for future-proofing data centers. High-density computing, AI workloads, and cloud scalability requirements continuously push electrical, cooling, and network capacities to new thresholds. Projects designed with infrastructure-first principles can accommodate incremental upgrades without extensive redesign or land expansion. Traditional land-first approaches often require costly retrofits or expansion to meet changing demands. Infrastructure-aligned facilities provide scalable frameworks from the outset. Operators emphasize that modularity in power, mechanical systems, and fiber connectivity enables phased growth while maintaining reliability and efficiency. This methodology shows how infrastructure-centric planning ensures adaptability in a rapidly evolving digital ecosystem.

Forward-looking strategies integrate predictive analytics and AI-driven operational monitoring. These tools optimize infrastructure utilization by tracking power consumption, cooling efficiency, and network latency. Operators can anticipate constraints before they affect service. This allows preemptive scaling of systems. Land considerations, while still necessary, are largely reactive rather than predictive. Combining infrastructure alignment with data-driven operational intelligence creates a resilient, adaptable, and scalable platform for next-generation workloads. The ability to integrate new technologies seamlessly distinguishes infrastructure-focused projects from traditional land-centric models.

Strategic Implications for Industry Stakeholders

The shift from land-driven to infrastructure-driven development carries major implications for all stakeholders. Investors, operators, utilities, regulators, and local governments must align planning, investment, and operations around infrastructure readiness. Institutional capital favors projects with verified power, robust fiber, and mechanical resilience. Utilities play an increasingly central role because grid timing and scalability directly affect project feasibility. Municipalities seeking investment now emphasize infrastructure incentives rather than land availability alone. This holistic view redefines competitive advantage in the data center sector. Infrastructure has become the critical axis around which expansion decisions revolve.

Operators note this evolution transforms short-term project planning and long-term strategy. Infrastructure-first principles guide site selection, capital allocation, workforce development, and operational management. Land remains important but now derives value from underlying infrastructure potential. Organizations adopting this approach gain competitive differentiation, reduce execution risk, and improve operational efficiency. This creates a resilient foundation for future growth. The paradigm confirms that modern data center expansion is inseparable from infrastructure alignment, making land a secondary consideration.