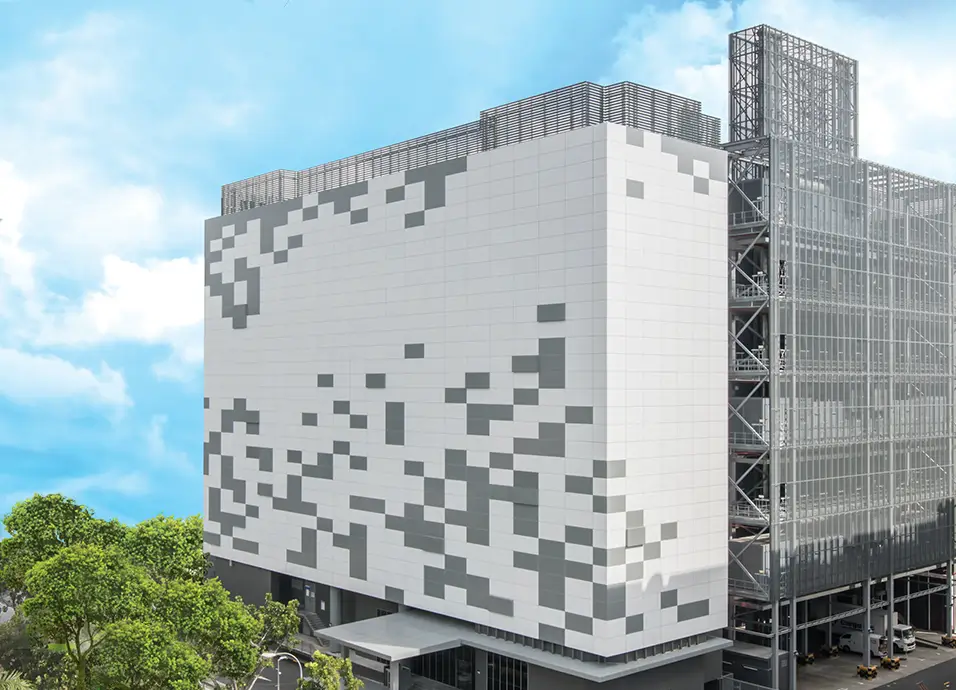

a tier III colocation data centre and 5 Science Park Drive (credit: CapitaLand Ascendas REIT)

The Board of Directors of CapitaLand Ascendas REIT Management Limited (the Manager), the manager of CapitaLand Ascendas REIT (CLAR), reports that distributable income for the six months ended 30 June 2025 (1H 2025) was stable at S$331.1 million, an increase of 0.1% year-on-year (YoY).

Taking into account an enlarged unit base of approximately 4.4 billion (+0.7% YoY) following the issuance of new units pursuant to CLAR’s private placement in May 2025 to fund acquisitions, Distribution per Unit (DPU) for 1H 2025 declined slightly to 7.477 Singapore cents (-0.6% YoY).

Gross revenue for 1H 2025 decreased by 2.0% YoY to S$754.8 million mainly due to the divestments of five properties in Australia (February 2024), Singapore (November 2024) and the US (June 2025), as well as the decommissioning of a property in the UK for redevelopment in June 2024. The decrease was partially offset by the acquisition of a property in the US in January 2025. Consequently, net property income decreased by 0.9% YoY to S$523.4 million.

Mr William Tay, Chief Executive Officer and Executive Director of the Manager, said, “Despite the ongoing macroeconomic uncertainties, CLAR’s distributable income of S$331.1 million and DPU of 7.477 cents for 1H 2025 were stable. This underscores the continued strength of our diversified portfolio, operational management and disciplined execution of our capital management strategies.”

“CLAR is set to add approximately S$725 million of prime, income-producing assets in Singapore. 9 Tai Seng Drive, a Tier III colocation data centre and 5 Science Park Drive, a premium business space property are well-located, modern properties that are fully leased to reputable tenants and will contribute positively to our income stream. These two properties will further anchor CLAR in Singapore, with Singapore accounting for about 67% of AUM when the transactions are completed,” Mr Tay added. “We will stay responsive to changing market conditions and are confident of navigating through these uncertain times.”

Value-adding Initiatives

Accretive Acquisitions

In 1H 2025, the Manager successfully completed the acquisition of DHL Indianapolis Logistics Center, a modern logistics property in Indianapolis, the US, at a total acquisition cost of S$153.4 million.

The acquisitions of 9 Tai Seng Drive, a Tier III colocation data centre in Singapore, and 5 Science Park Drive, a premium business space property in Singapore, for an aggregate acquisition cost of approximately S$724.6 million were approved by Unitholders at the EGM held on 30 July 2025. The acquisitions of 9 Tai Seng Drive and 5 Science Park Drive are expected to be completed in the second half of 2025.

All three properties are high-quality assets that are fully occupied and will further strengthen CLAR’s portfolio and income stream.

Redevelopments and Asset Enhancement Initiatives (AEIs)

The Manager continued its efforts to optimise returns from the existing portfolio by repositioning and upgrading properties through redevelopments and AEIs.

The redevelopment of 1 Science Park Drive, a premium business space and life sciences property in Singapore, was completed in 1H 2025 at a total development cost of about S$883.0 million. Located within the Geneo life sciences and innovation cluster at Singapore Science Park adjacent to the Kent Ridge MRT station, the property has attracted strong leasing interest with 95% of the total net lettable area of 103,200 square metres committed or in advanced negotiations. The majority of tenants are from the life sciences, innovation and technology sectors. Jointly owned by CapitaLand Development (66% stake) and CLAR (34% stake), the redevelopment intensified the gross plot ratio threefold to 3.6, creating a world-class Grade A business space and life sciences property complemented by vibrant retail elements.

In 1H 2025, two AEIs at 80 Bendemeer Road in Singapore and Perimeter Two in Raleigh, the US, totalling S$4.6 million were completed, further improving the quality of the existing portfolio.

Currently, there are six ongoing projects, including one development, three redevelopments and two AEIs, with an aggregate investment of S$498.4 million. These projects are scheduled for completion between 3Q 2025 and 1Q 2028. The Manager remains committed to identifying and executing such organic growth initiatives to create long-term value for Unitholders.

Divestment

In line with the Manager’s proactive capital recycling strategy to optimise returns for Unitholders, the Manager divested Parkside, a business space property in Portland, the US, for S$26.5 million in June 2025. The sale price represented a premium of approximately 45% to the independent market valuation of S$18.25 million as at 31 December 2024.

A Diversified and Resilient Portfolio

As of 30 June 2025, CLAR’s portfolio was worth S$16.8 billion with a customer base of approximately 1,790 tenants from more than 20 industries.

The portfolio is geographically diversified across the developed markets of Singapore (65% or S$11.0 billion), Australia (13% or S$2.1 billion), the US (12% or S$2.0 billion) and the UK/Europe (10% or S$1.7 billion). CLAR’s portfolio of 225 investment properties [1] spans across three key segments: Business Space & Life Sciences (45%), Industrial & Data Centres (29%) and Logistics (26%).

As of 30 June 2025, the occupancy rate of the portfolio remained healthy at 91.8% (31 March 2025: 91.5%). The occupancy rate of the Singapore portfolio was 91.2% (31 March 2025: 91.6%) and that of the US portfolio was 87.3% (31 March 2025: 88.0%). The occupancy rate of the Australia portfolio increased to 93.1% while that of the UK/Europe portfolio remained high at 98.9% (31 March 2025: 98.9%).

In 1H 2025, the average rental reversion [2] for leases renewed in multi-tenant buildings was 9.5%. For lease renewals in 2Q 2025, a positive average rental reversion of 8.0% was achieved. Average rental reversions were 7.8% in Singapore, 10.9% in the US and 3.5% in Australia in 2Q 2025. There were no lease renewals in the UK/Europe in 2Q 2025.

The largest sources of new demand by gross rental income in 1H 2025 were the Logistics & Supply Chain Management, IT & Data Centres and Education & Media sectors.

The weighted average lease expiry (WALE) of the portfolio was 3.7 years as of 30 June 2025. Approximately 8.9% of CLAR’s gross rental income was due for renewal for the remainder of FY 2025.

Effective Capital Management

As at 30 June 2025, the aggregate leverage stood at a healthy 37.4% (31 March 2025: 38.9%) following the successful equity fund raising of S$500.0 million in May 2025.

In April 2025, CLAR secured a US$198 million 5-year committed revolving credit facility to refinance existing borrowings which extended the weighted average term of debt to 3.2 years as at 30 June 2025 (31 March 2025: 3.1 years).

With a high proportion of fixed rate debt at 75.9% and a well-spread debt maturity profile, CLAR’s weighted average all-in cost of borrowing is stable at 3.7% [3] in 1H 2025 (1Q 2025: 3.6%).

CLAR’s strong financial metrics comfortably exceeded statutory and bank loan covenants. The Interest Coverage Ratio (ICR) was 3.7x, well above the statutory limit of 1.5x and remains robust even under stress scenarios. A 10% decrease in EBITDA or a 100 basis points (bps) increase in weighted average interest rates would result in an ICR of 3.4x and 2.9x respectively.

CLAR maintained a high natural hedge level of approximately 76% for its overseas investments, which accounted for about 35% (S$5.8 billion) of the total portfolio value of S$16.8 billion. This minimised the impact of adverse exchange rate fluctuations.

With prudent financial policies in place and a stable operating track record, CLAR continued to maintain its A3 investment grade credit rating from Moody’s.

Continued Sustainable Impact

The Manager continued to progress towards achieving CLAR’s long-term sustainability targets.

In 1H 2025, the number of green-certified properties increased by two, reaching a total of 86. This represented 49% of the total portfolio by gross floor area. Additionally, one property in Singapore was fitted with solar panels, bringing the total number of solar-equipped properties to 27 as of 30 June 2025. Green lease coverage by net leasable area improved to 59% of the overall CLAR portfolio, up from 54% as of 31 December 2024.

Outlook

According to the International Monetary Fund (IMF), global growth is projected at 2.8% in 2025 and 3.0% in 2026 (source: IMF April 2025 report). This latest forecast was revised downward from the January 2025 estimate due to a highly unpredictable environment marked by escalating trade tensions and adjustments in financial markets, with downside risks dominating the outlook.

Singapore

Based on advance estimates by the Ministry of Trade and Industry (MTI), Singapore’s gross domestic product (GDP) grew by 4.3% YoY in 2Q 2025, extending the 4.1% growth recorded in the previous quarter. The MTI forecasts Singapore’s GDP growth for 2025 to range between 0.0% and 2.0% due to significant uncertainties and downside risks in the global economy in the second half of 2025.

Singapore’s core inflation rate (excluding accommodation and private transport) was unchanged at 0.6% YoY in June 2025. In July 2025, the Monetary Authority of Singapore maintained its monetary policy after two consecutive rounds of easing given uncertainties surrounding the economy and inflation.

Singapore remains the cornerstone of CLAR’s portfolio. As of 30 June 2025, the Singapore portfolio, worth approximately S$11.0 billion, represents 65% of CLAR’s total portfolio value. It comprises Business Space & Life Sciences, Industrial & Data Centres and Logistics properties. The portfolio is expected to grow to approximately S$11.8 billion with the addition of 9 Tai Seng Drive and 5 Science Park Drive. The Manager will continue to identify opportunities to further strengthen the portfolio and optimise returns through acquisitions, redevelopments and AEIs, as well as divestments.

US

In 2Q 2025, the US economy increased at an annualised rate of 3.0% quarter-on-quarter, primarily due to an increase in imports and higher consumer spending, partially offset by decreases in investment and exports (source: US Bureau of Economic Analysis). The IMF estimates that the US economy would grow 1.8% in 2025.

Core Consumer Price Index (CPI) rose 2.9% for the 12 months ending June 2025, maintaining a similar pace to the previous period. In July 2025, the US Federal Reserve held the target range for the federal funds rate at 4.25% to 4.50%. While economic activity has continued to expand, inflation remained elevated and uncertainty about the economic outlook persisted.

As of 30 June 2025, CLAR’s US portfolio was valued at S$2.0 billion, comprising Business Space & Life Sciences and Logistics properties. The Manager remains proactive in asset management and cautious on acquisition opportunities to expand CLAR’s logistics presence given the current lack of clarity surrounding US trade policies and its potential impact. CLAR’s US portfolio benefits from a diversified tenant base and a long WALE of 4.4 years (Business Space & Life Sciences: 4.0 years, Logistics: 6.1 years).

Australia

In 1Q 2025, Australia’s economy grew by 1.3% YoY, matching the growth rate of the previous quarter (source: Australian Bureau of Statistics). The IMF forecasts that Australia’s economy would grow 1.6% in 2025.

Australia’s All groups CPI rose 2.1% for the 12 months to June 2025, down from 2.4% for the 12 months to March 2025 (source: Australian Bureau of Statistics) and within the Reserve Bank of Australia’s (RBA) target range of 2% to 3%. After lowering the cash rate target by 50 bps in 1H 2025 in response to moderating inflation, the RBA maintained the cash rate target at 3.85% in July 2025.

As of 30 June 2025, CLAR’s Australia portfolio amounted to S$2.1 billion, comprising Business Space and Logistics properties. The portfolio’s healthy occupancy rate of 93.1% (Business Space: 95.5%, Logistics: 92.7%) and a WALE of 3.4 years (Business Space: 3.5 years, Logistics: 3.4 years) will contribute to rental income.

UK/Europe

In 1Q 2025, the UK economy grew by 1.3% YoY (source: Office for National Statistics). The IMF projected that the UK economy would expand by 1.2% in 2025. In June 2025, the Bank of England maintained the Bank Rate at 4.25%, taking a gradual and careful approach to further easing of monetary policy.

In 1Q 2025, the euro area economy grew by 1.5% YoY (source: European Commission). The European Commission expects GDP growth of 0.9% in 2025 in the euro area. In July 2025, the European Central Bank kept its key interest rates unchanged as it is determined to ensure that inflation stabilises at its 2% target in the medium term.

As of 30 June 2025, CLAR’s UK/Europe portfolio worth S$1.7 billion comprises Logistics and Data Centre properties. With a high occupancy rate of 98.9% (Logistics: 100%, Data Centres: 89.4%) and a long WALE of 5.5 years (Logistics: 5.9 years, Data Centres: 5.3 years), the portfolio is expected to generate stable returns. The Manager plans to redevelop a data centre in the UK and will capitalise on future opportunities to enhance the portfolio quality through acquisitions, redevelopments and AEIs, as well as divestments.

There remain significant uncertainties surrounding global trade dynamics, inflation trends and monetary policies of major central banks.

CLAR’s stable performance is underpinned by its diversified and resilient portfolio that is anchored in Singapore. The WALE of CLAR’s portfolio is long at 3.7 years and the large customer base comprises approximately 1,790 tenants from more than 20 different industries.

With a strong balance sheet and healthy liquidity, CLAR remains nimble and disciplined in pursuing accretive opportunities to enhance its portfolio and deliver sustainable returns to Unitholders.

[1] Excludes two properties in Singapore, one property in the UK and one property in the US which are under development.

[2] Percentage change of the average gross rent over the lease period of the renewed leases against the preceding average gross rent from lease start date. This takes into account renewed leases that were signed in the respective period and average gross rents are weighted by area renewed.

[3] For total gross borrowings of S$6.6 billion comprising of SGD, USD, AUD, GBP and EUR debts.