The AI infrastructure race no longer hinges on chips alone. Instead, power trains and cooling architectures now define who scales and who stalls.

Legrand has moved decisively to tighten its grip on both fronts. The company announced the acquisition of Kratos Industries and confirmed a strategic investment in Accelsius, signaling a coordinated expansion across critical power and advanced thermal management. Together, these actions reposition Legrand from a component supplier to an end-to-end infrastructure orchestrator for AI-ready data centers.

Power First: Kratos Extends the Critical Backbone

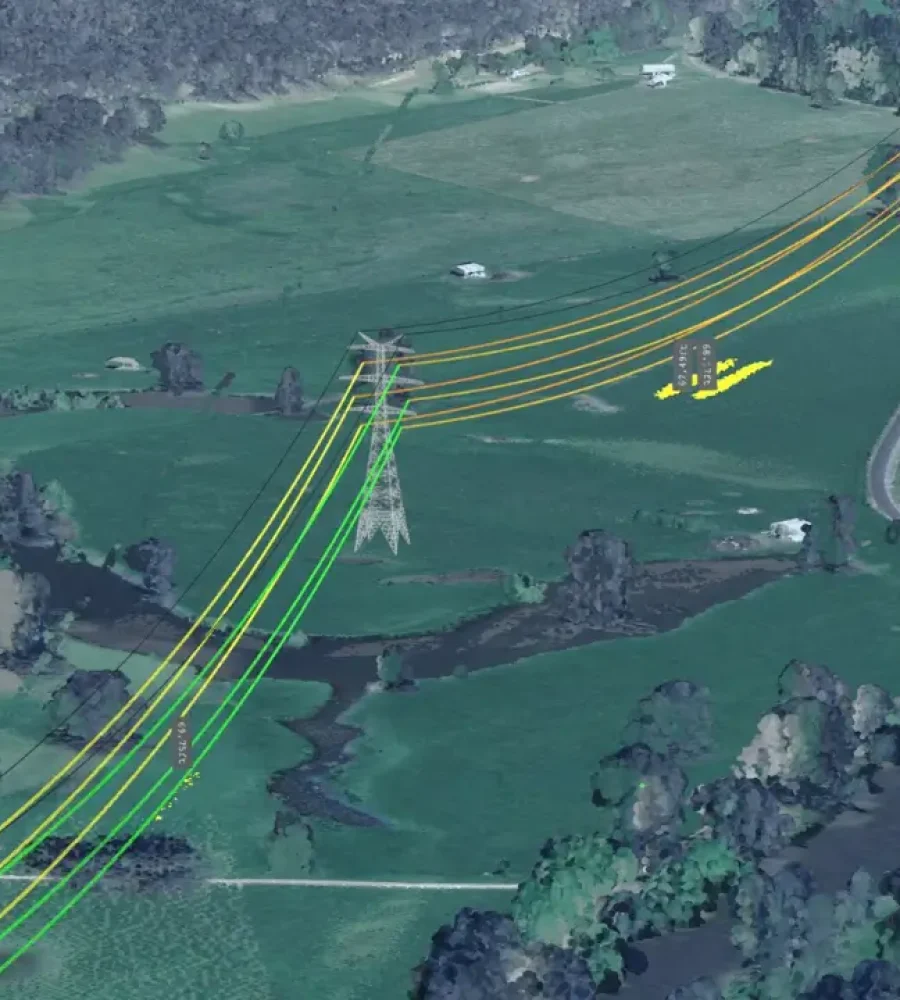

The acquisition of Kratos strengthens Legrand’s presence in gray space power systems, where reliability dictates uptime and scalability determines competitive advantage. Based in Arvada, Kratos manufactures low-voltage switchboards, medium-voltage switchgear, and integrated power systems tailored to data center and industrial environments.

Importantly, Kratos operates with a vertically integrated, engineered-to-order production model. That capability aligns tightly with hyperscale and colocation buildouts that increasingly demand speed without compromising customization. As AI clusters grow denser, operators cannot afford procurement delays or rigid design frameworks.

By integrating Kratos, Legrand broadens its critical power portfolio beyond its established gray space offerings such as cable bus, load banks, and cable tray systems. Moreover, it reinforces its white space solutions portfolio, which already includes busway, busduct, and rack-level power distribution units.

“Data centers are facing unprecedented pressure to build out digital infrastructure at scale and with extreme reliability,” said Pedro Mendieta, Data, Power, and Control (DPC) President, Legrand, North and Central America. “By welcoming Kratos to Legrand, we are deepening our ability to serve the complete data center power train, ensuring our customers have a single, trusted partner for their entire power ecosystem.”

The emphasis on a “complete power train” reflects a structural industry shift. Operators increasingly seek fewer vendors with broader accountability. Consequently, consolidation across power distribution layers reduces integration risk and accelerates deployment timelines.

“Joining Legrand marks a pivotal chapter in our journey,” said Rowan Koons, who will assume the role of VP/General Manager of the Kratos business unit within Legrand’s DPC division. “By leveraging Legrand’s global supply chain and operational infrastructure, we can accelerate growth and better support the massive, complex projects our customers are undertaking. We look forward to collaborating with the Legrand team to deliver the next generation of power solutions.”

Notably, Legrand does not merely acquire capacity; it acquires execution velocity. That distinction matters as AI infrastructure investment compresses build cycles from years to quarters.

Cooling Next: Accelsius and the Two-Phase Pivot

However, power alone cannot unlock AI density. Thermal constraints increasingly define rack-level design limits. Therefore, Legrand has paired its power expansion with a forward-looking bet on liquid cooling.

The company participated in a Series B funding round for Accelsius, a pioneer in two-phase, direct-to-chip liquid cooling engineered for gigawatt-class AI facilities. Through this partnership, both companies will collaborate on joint development initiatives across the white space, particularly integrating liquid cooling systems directly into rack infrastructure.

As AI workloads intensify, rack densities continue to climb. Traditional air cooling struggles to sustain thermal equilibrium under extreme compute loads. In contrast, two-phase direct-to-chip systems remove heat at the processor level, enabling significantly higher densities while lowering energy overhead for cooling.

Accelsius’ architecture relies on phase-change principles to dissipate heat efficiently. Consequently, operators can reduce thermal bottlenecks without expanding physical footprints. That advantage directly supports the economics of AI factories, where megawatt increments translate into competitive differentiation.

For Legrand, the strategic logic becomes clear. It already commands strong positions in rack power and distribution. By embedding liquid cooling into rack-level infrastructure, it creates an integrated white space stack that unifies power and thermal design under a single strategic umbrella.

A Coordinated Infrastructure Doctrine

Taken together, the Kratos acquisition and the Accelsius partnership signal more than opportunistic expansion. They reveal a deliberate infrastructure doctrine. First, Legrand consolidates the gray space backbone through engineered-to-order MV and LV power systems. Second, it extends into advanced white space cooling that directly addresses AI-driven density pressures. Third, it integrates these layers to reduce fragmentation in mission-critical deployments.

This approach aligns with broader AI capital expenditure trends. Hyperscalers and enterprise operators alike prioritize resilience, modularity, and energy efficiency. Moreover, they increasingly prefer partners capable of delivering interoperable ecosystems rather than isolated components. Legrand remains focused on providing engineered-to-order, customer-first solutions that scale with AI and high-performance computing growth. By synchronizing power distribution and next-generation cooling, it positions itself as a strategic infrastructure integrator rather than a peripheral supplier.

In an era where silicon headlines dominate coverage, infrastructure quietly determines outcomes. With these dual moves, Legrand asserts that AI readiness begins not at the processor, but at the foundation.