America’s solar boom is no longer constrained by panels alone. The deeper question is whether the country is prepared to localize the invisible layers of infrastructure that determine whether projects move swiftly from blueprint to grid connection.

The surge in solar deployment across the United States has revealed a persistent truth: timelines, not technology, increasingly define competitiveness. Developers may secure land, financing and offtake agreements, yet still find themselves waiting on foundational components that quietly shape the entire construction sequence. In large-scale solar, what lies beneath the array often dictates what happens above it.

The conversation around domestic manufacturing has largely centered on modules, inverters and battery systems. But foundations, the hardware that stabilizes racking and tracking systems in varied soil conditions are emerging as strategic levers in project execution. When these components are sourced from abroad, developers inherit shipping uncertainty, tariff exposure and fragmented quality oversight. When they are produced domestically, they introduce predictability into the earliest stages of construction.

This shift reflects a broader recalibration in U.S. energy policy and market psychology. The Inflation Reduction Act ignited investment across the renewable value chain, yet policy incentives alone do not compress lead times. Manufacturing discipline, logistical proximity and transparent supply chains do.

Vertical Integration and Risk Control

Vertical integration is gaining renewed attention in this context. Companies capable of engineering, fabricating and delivering core infrastructure within a unified production system offer more than convenience; they offer risk insulation. In an era defined by supply-chain volatility, that insulation carries measurable value. Predictability, once a secondary consideration, is becoming central to project finance models and power purchase negotiations.

There is also a durability dimension to the domestic debate. As solar assets are designed for decades of operation, foundational reliability becomes an economic safeguard. Poor soil adaptation or inconsistent fabrication standards can introduce maintenance burdens that outlive construction savings. Long-term resilience, therefore, starts at ground level.

The strategic implications stretch further. Energy security increasingly intersects with industrial policy. As electrification accelerates from data centers to transportation solar is no longer an environmental add-on but a structural pillar of national power supply. Anchoring its supply chain domestically aligns with a broader ambition to reduce external dependencies in critical infrastructure.

Yet readiness is not guaranteed. Domestic manufacturing must balance cost competitiveness with scale. It must also respond to evolving engineering standards as tracker systems and mounting platforms become more sophisticated. Speed without quality would undermine the very predictability developers seek.

The Foundation Question

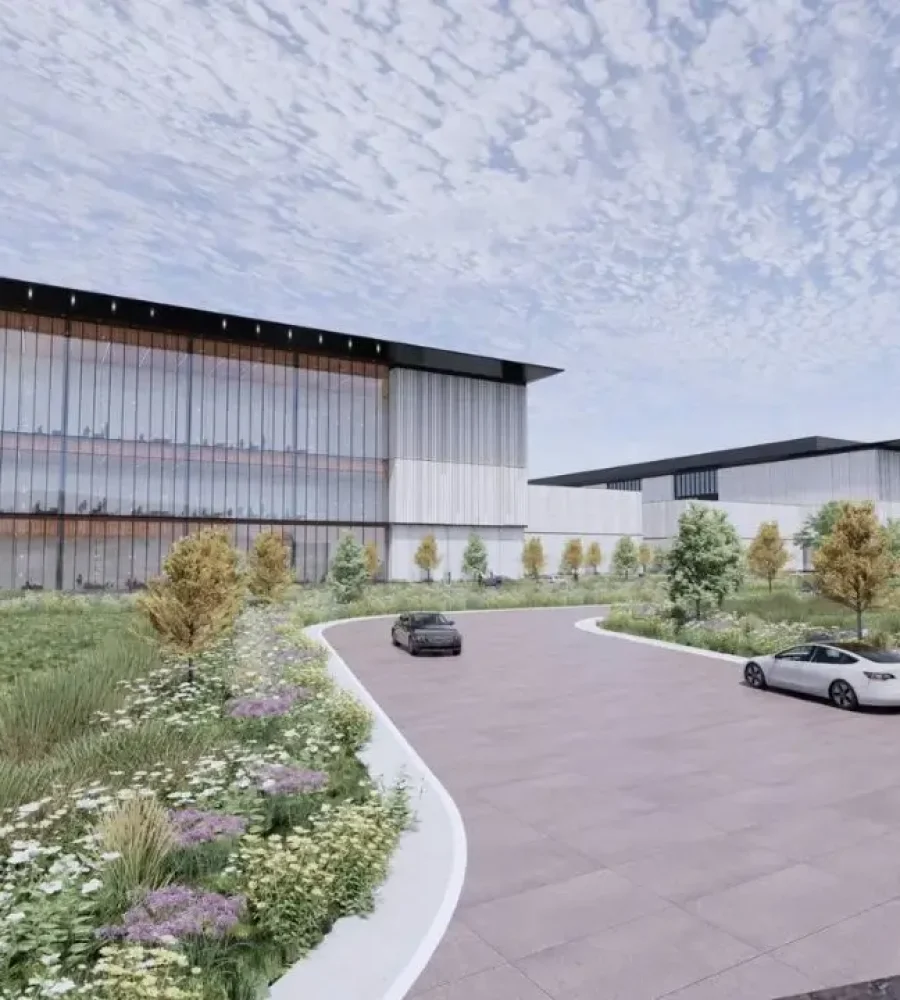

The momentum is unmistakable. A new generation of U.S.-based manufacturers is positioning itself not merely as suppliers, but as partners embedded in project lifecycles. Facilities dedicated to solar-specific components signal a long-term bet on sustained demand rather than cyclical opportunity. For policymakers and investors alike, the underlying question remains: can America convert its policy-driven solar surge into an industrial renaissance that extends beyond panels and into every structural layer of deployment?

If the answer is yes, the transformation will not be measured solely in gigawatts installed, but in the resilience of the supply chains that support them. The foundation of America’s solar future may ultimately determine how securely the nation stands in the global clean energy race.