Photo: aVance 1_Hyderabad: CapitaLand India Trust reported robust FY2025 growth on the back of higher rental income across its portfolio, with contributions from assets such as aVance 1 at aVance HITEC City, Hyderabad; credit: CapitaLand India Trust.

CapitaLand India Trust (CLINT or the Trust) announced a positive set of results for the financial year ended 31 December 2025 (FY 2025), underpinned by contributions from successful developments, improved operating performance, strategic portfolio reconstitution initiatives and effective capital management.

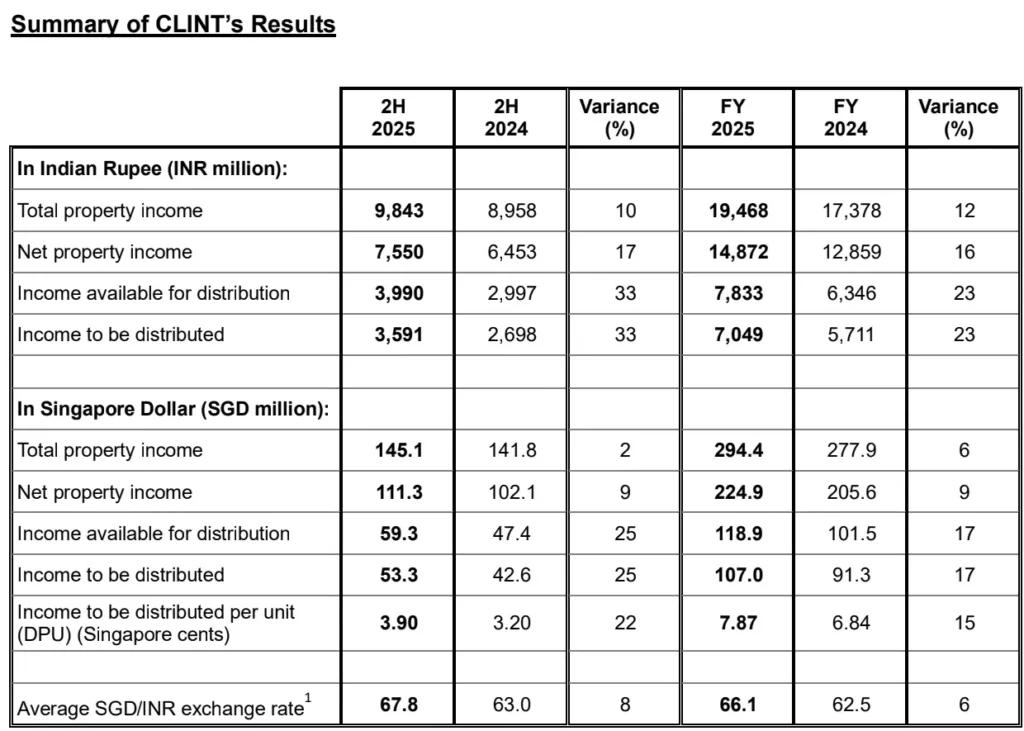

CLINT’s 2H 2025 distribution per unit (DPU) rose 22% year-on-year (YoY) to 3.90 Singapore cents. With record date on Friday, 13 February 2026, CLINT’s unitholders will receive the 2H 2025 DPU on Thursday, 19 March 2026. FY 2025 DPU grew 15% YoY to 7.87 Singapore cents, translating to a distribution yield of 6.5% based on the closing price of S$1.22 as at 31 December 2025.

For the period 1 July 2025 to 31 December 2025 (2H 2025), income available for distribution grew 33% YoY to INR 3,990 million. The positive performance was driven by improved operating performance and income contributions from newly completed developments, prior acquisitions and higher interest income from its six forward purchases that are under development.

Year-on-year, total property income for 2H 2025 and FY 2025 grew by 10% to INR 9.8 billion and 12% to INR 19.5 billion respectively. Net property income (NPI) grew 17% YoY to INR 7.6 billion in 2H 2025 and 16% YoY to INR 14.9 billion for FY 2025. The NPI margin improved YoY from 74.0% to 76.4%. Excluding the one-off adjustments, NPI margins improved from 74.8% to 75.4%, driven by proactive portfolio management to maximise efficiency and drive leasing.

The valuations as at 31 December 2025 reported a 19% YoY increase in CLINT’s portfolio property value to INR 266.4 billion (S$3.8 billion) on a like-for-like basis, excluding the divestments of CyberVale, Chennai and CyberPearl, Hyderabad.

Mr Manohar Khiatani, Chairman of CapitaLand India Trust Management Pte. Ltd. (the Trustee Manager of CLINT), said: “We are pleased to report strong FY 2025 financial results, which reflect the team’s strategic focus and strong execution capabilities. The team’s disciplined efforts to strengthen operating margins, optimise capital management, unlock value through strategic divestments and developing a strong growth pipeline have been instrumental in achieving this solid performance in 2025. As we look ahead to 2026, I am confident that our strategies – underpinned by a strong balance sheet, a high-quality portfolio and disciplined execution– will position CLINT well to capture opportunities and deliver sustainable returns for unitholders.”

Mr Gauri Shankar Nagabhushanam, Chief Executive Officer of the Trustee-Manager, said: “CLINT’s strong performance in FY 2025 reflects the momentum we have been generating across multiple growth engines. We continue to strengthen our portfolio and balance sheet by improving efficiencies, pursuing forward purchases and developments, and recycling capital through strategic divestments. In parallel, we are also actively optimising our capital structure. We remain focused on sustaining this momentum, reinforcing each growth pillar to support steady and resilient growth going forward.”

Resilient Portfolio Performance

As at 31 December 2025, CLINT achieved a committed portfolio occupancy of 91% [2] and registered strong rental reversions of 21% over the last 12 months.

Proactive Capital Management

CLINT’s gearing stood at 39.6% as at 31 December 2025. Of CLINT’s total borrowings, 72.6% are on fixed interest rates, and 53% are hedged into INR. The Trust maintains a debt headroom of S$967 million.

During the year, CLINT diversified its funding sources through perpetual securities and took significant steps to onshore its debt in India. CLINT issued its first bond issuance in India on 2 January 2026, which was rated AAA by Crisil Ratings Limited. It has also signed two onshore sustainability-linked loans in India totalling INR 21 billion (S$300 million). The onshoring of debt will enable CLINT to tap on the lower interest rate environment in India as well as increase long term cost savings on interest expense and tax, which will improve its income available for distribution.

Forward Purchases

The forward purchase programme remains a key growth engine for CLINT, providing consistent interest income and a visible pipeline of quality assets for future portfolio expansion. In February 2025, CLINT entered into a forward purchase agreement for a 1.1 million sq ft office project at Nagawara, Outer Ring Road, Bangalore.

As at 31 December 2025, the Trust had six forward purchase assets under development, totalling 7.3 million sq ft. Interest-bearing long-term receivables deployed into these projects grew by 25.3% YoY to S$381.6 million, which were a key contributor to the uplift in interest income for FY 2025.

Portfolio Reconstitution Efforts

In August 2025, CLINT completed its maiden data centre development – CapitaLand Data Centre Navi Mumbai Tower 1, which has started progressive handover to the hyperscaler tenant from 3Q 2025. Tower 2 of CapitaLand Data Centre Navi Mumbai has now also been fully leased to the same global hyperscaler, significantly enhancing the leasing momentum of the data centre portfolio.

In December 2025, CLINT announced divestment of 20.2% stakes in its three data centres under development to CapitaLand India Data Centre Fund for an estimated total purchase consideration [3] of INR 7.02 billion (S$99.73 million) [4]. The transaction is expected to be completed by end February 2026.

In September 2025, CLINT completed its inaugural divestment of CyberPearl, Hyderabad and CyberVale, Chennai for INR 11,031 million (approximately S$161.7 million), as part of its strategy in active portfolio reconstitution to unlock value and strengthen financial agility.

On the development front, CLINT has embarked on the redevelopment of Orion building in International Tech Park Hyderabad, into a 1.0 million sq ft building with target completion in 4Q 2028. The development of MTB 7 at International Tech Park Bangalore is ongoing and on track for completion in 3Q 2027.

As at 31 December 2025, CLINT’s completed floor area stood at 21.7 million sq ft with total development potential of 3.7 million sq ft in its IT business parks. Construction activities for existing projects, including committed forward purchase pipeline, are progressing as scheduled.

About CapitaLand India Trust (www.clint.com.sg)

CapitaLand India Trust (CLINT) was listed on the Singapore Exchange Securities Trading Limited (SGX-ST) in August 2007 as the first Indian property trust in Asia. Its principal objective is to own income-producing real estate used primarily as business space in India. CLINT may also develop and acquire land or uncompleted developments primarily to be used as business space, with the objective of holding the properties upon completion. As at 31 December 2025, CLINT’s assets under management stood at S$3.8 billion.

CLINT’s portfolio includes eight world-class IT business parks, three industrial facilities, one logistics park and four data centre developments in India, with total completed floor area of 21.7 million square feet spread across Bangalore, Chennai, Hyderabad, Pune and Mumbai. CLINT is focused on capitalising on the fast-growing IT industry and logistics/industrial asset classes in India, as well as proactively diversifying into other asset classes such as data centres.

CLINT is structured as a business trust, offering stable income distributions similar to a real estate investment trust. CLINT focuses on enhancing shareholder value by actively managing existing properties, developing vacant land in its portfolio, and acquiring new properties. CLINT is managed by CapitaLand India Trust Management Pte. Ltd. The Trustee-Manager is a wholly owned subsidiary of Singapore-listed CapitaLand Investment Limited, a leading global real asset manager with a strong Asia foothold.

About CapitaLand Investment Limited (www.capitalandinvest.com)

Headquartered and listed in Singapore in 2021, CapitaLand Investment Limited (CLI) is a leading global real asset manager with a strong Asia foothold. As at 5 November 2025, CLI had S$120 billion of funds under management held via stakes in eight listed real estate investment trusts and business trusts and a suite of private real asset vehicles that invest in demographics, disruption and digitalisation-themed strategies. Its diversified real asset classes include retail, office, lodging, industrial, logistics, business parks, wellness, self-storage, data centres and private credit.

CLI aims to scale its fund management, lodging management and commercial management businesses globally and maintain effective capital management. As the investment management arm of CapitaLand Group, CLI has access to the development capabilities of and pipeline investment opportunities from CapitaLand Group’s development arm.

CLI is committed to growing in a responsible manner, delivering long-term economic value and contributing to the environmental and social well-being of its communities.

1 Average exchange rates used in the income statements.

2 Excludes Logistics Park and Data Centres.

3 The purchase consideration for the Transaction will be determined at the completion date. Please refer to the announcement titled “Proposed Divestment of 20.20% interest in three data centre assets located in India and the Proposed Joint Venture in respect of these assets” announced on 31 December 2025 for further details.

4 Exchange rate of S$1 = INR70.4.