Acquisition strengthens CLAR’s presence in the Midwest, a key logistics market in the US

Singapore, 16 January 2026 – CapitaLand Ascendas REIT Management Limited, as the manager (the Manager) of CapitaLand Ascendas REIT (CLAR) is pleased to announce the acquisition of DHL Canal Winchester, a modern Class A logistics property in Columbus, Ohio, the United States (US), for S$94.5 million1 (US$73.8 million) (the Purchase Consideration). Upon completion of the acquisition, Exel Inc. d/b/a DHL Supply Chain (USA) (DHL), a global leader in the logistics industry, will enter into a long-term leaseback of the property.

“The accretive acquisition underscores our strategy of selectively investing in logistics growth markets in the US with excellent connectivity and deep occupier demand, while leveraging our strong partner network to drive long-term value for unitholders. This acquisition marks CLAR’s second sale and leaseback transaction with DHL in a key US logistics hub. Similar to our first transaction with DHL for DHL Indianapolis Logistics Center which was completed in January 2025, DHL Canal Winchester will strengthen CLAR’s resilient income with its long-term lease and built-in annual rental escalations, which is expected to further enhance the quality and stability of our US logistics portfolio.” – Mr William Tay, Executive Director and Chief Executive Officer of the Manager

Rationale and Merits of the Acquisition

1. Strengthens CLAR’s logistics portfolio in the Midwest, a key logistics market in the US

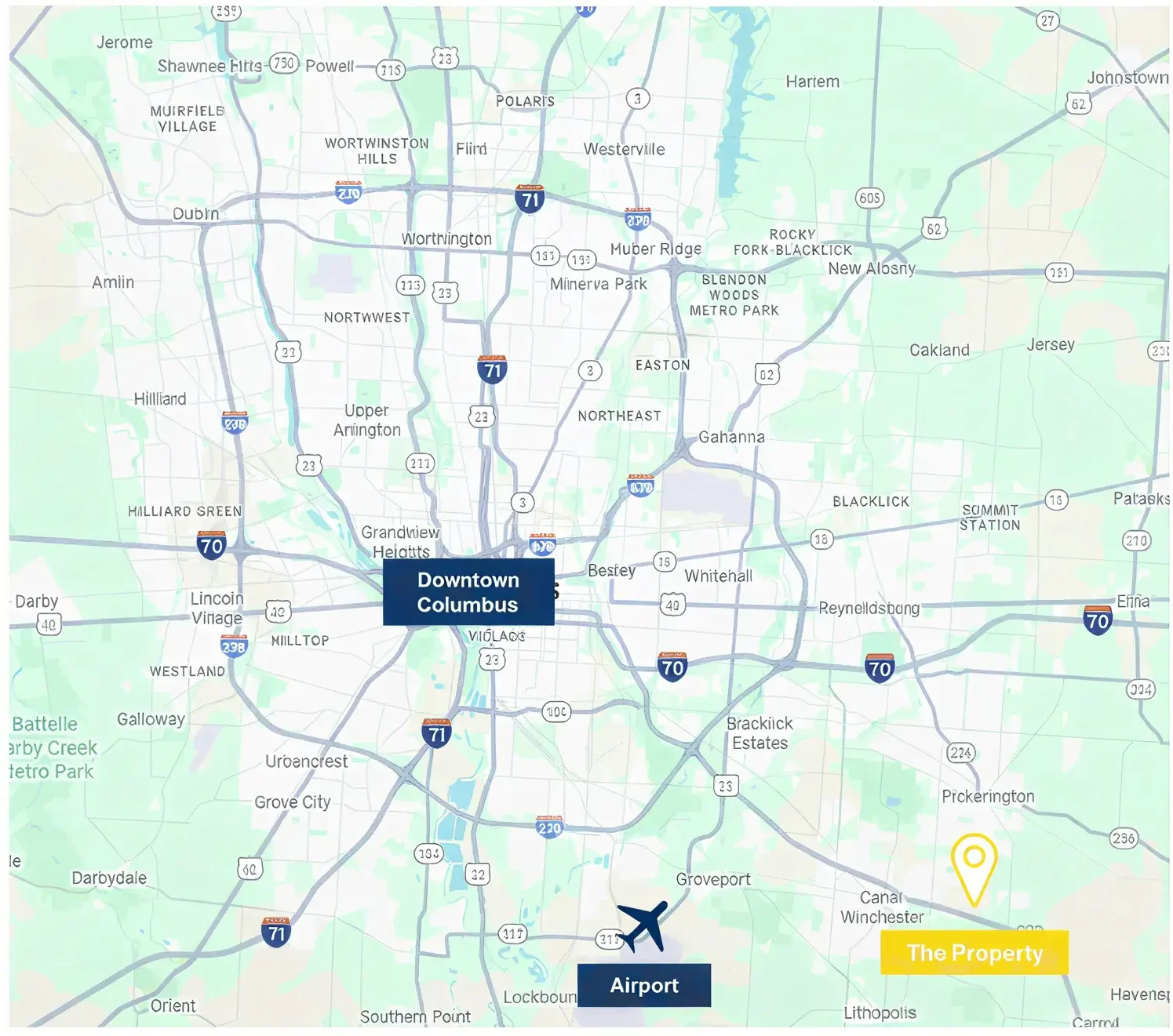

With excellent connectivity to air, rail and road transportation networks, DHL Canal Winchester is well-positioned to serve as a regional logistics distribution hub and will strengthen CLAR’s presence in the Midwest.

It is situated along Highway 33, less than 30 kilometres from Downtown Columbus and Rickenbacker International Airport, which is a cargo-dedicated international logistics hub with direct flights to Asia, Europe and the Middle East2. A coast-to-coast rail service is available at the airport through two of the US’ national rail carriers. The property has easy access to three other interstate highways. This includes Interstate 70, a major east-west artery stretching across 10 states in the US and Interstate 71, a north-south highway connecting Ohio and Kentucky.

DHL Canal Winchester will add to CLAR’s logistics portfolio in the US, which mainly comprises assets in the Midwest cities of Chicago, Kansas City and Indianapolis. These cities are major logistics hubs due to their strategic locations which provide easy access to a large proportion of the US population, as well as their excellent ground, water and air transportation networks3. The Midwest benefits from limited exposure to international trade, minimal oversupply and outsized manufacturing sectors which could potentially gain from increased domestic production4.

2. Modern Class A logistics property fully occupied by DHL with a long-term lease

The property was completed in 2024 and comprises a single-storey logistics building with a gross floor area (GFA) of 755,160 square feet (sq ft). Market-leading specifications include a high ceiling with a clear height of 12.2 metres (40 feet), cross-dock configuration, multiple points of ingress/egress and LED lighting. DHL Canal Winchester will enhance the quality of CLAR’s portfolio by increasing the proportion of modern logistics assets to 52.4% of CLAR’s US logistics portfolio by assets under management (AUM)5.

DHL will lease back the entire property under a long-term lease until December 2030 with options to renew for two additional five-year terms. The property’s long weighted average lease expiry of approximately five years and built-in annual rent escalation of 3.5% is expected to enhance the resilience of CLAR’s income stream.

3. Expands CLAR’s presence in markets with healthy logistics fundamentals

The acquisition aligns with CLAR’s strategy to grow its US logistics portfolio selectively.

Columbus is the sixth largest logistics market in the Midwest based on its market size of approximately 307.1 million sq ft6. Demand for industrial space in Columbus remained robust with positive net absorption outpacing new construction vacancies in 2025 which led to a decline in the vacancy rate for three consecutive quarters to 7.0% in 3Q 2025. Meanwhile, average asking rents in the market for industrial space increased 2.5% year-on-year7.

Columbus’ economy is supported by businesses in various industries including manufacturing, finance & insurance, professional & business services as well as the government8. The state of Ohio was ranked fifth in CNBC’s 2025 analysis of “America’s Top States for Business”, scoring favourably in categories such as infrastructure, cost of doing business, technology & innovation, as well as access to capital and cost of living.

Upon completion of the acquisition, the value of CLAR’s logistics AUM in the US will increase by 17.4% to approximately S$651.6 million9. CLAR’s logistics footprint in the US will also expand to 21 properties across five cities with a total GFA of approximately 5.9 million sq ft.

4. Distribution per unit (DPU) accretive acquisition

The first-year net property income (NPI) yield10 of the acquisition is attractive at approximately 7.4% pre-transaction costs and 7.2% post-transaction costs.

The acquisition is DPU-accretive on a pro forma basis. Assuming the acquisition was completed on 1 January 202411, the DPU accretion is expected to be approximately 0.012 Singapore cents or 0.1%.

Details of the acquisition

CLAR, through its indirect wholly owned subsidiary, Ascendas Reit Columbus 1 LLC, has entered into a sale and purchase agreement with RES Canal Winchester I LLC (the Vendor) to acquire the property. The Vendor is a wholly owned subsidiary of DHL.

The Purchase Consideration of S$94.5 million (US$73.8 million)12 was negotiated on a willing-buyer and willing-seller basis, and is payable in cash. It is a 3.3% discount to the independent market valuation13 of the Property of S$97.7 million (US$76.3 million) as at 1 January 2026.

The total acquisition cost of S$96.4 million (US$75.3 million) comprises the Purchase Consideration, the acquisition fee payable to the Manager of approximately S$0.9 million (US$0.7 million) (being 1% of the Purchase Consideration) and other transaction-related fees and expenses of approximately S$1.0 million (US$0.8 million).

The Manager intends to finance the total acquisition cost through a combination of internal resources, divestment proceeds and/or existing debt facilities.

The acquisition is expected to be completed in the first quarter of 2026.

9 On a pro forma basis as at 30 September 2025 and including Summerville Logistics Center which was announced

on 15 November 2024.

10 The NPI yield is derived assuming the estimated NPI expected in the first year after the acquisition.

11 The estimated pro forma impact is calculated based on the following assumptions: (i) CLAR had completed the

acquisition on 1 January 2024 and held the property through 31 December 2024; (ii) the acquisition was funded

based on a funding structure of 60% equity and 40% debt and (iii) the Manager elects to receive 80% of its base

fee in cash and 20% in units of CLAR.

12 Subject to closing adjustments.

13 The valuation was commissioned by the Manager and HSBC Institutional Trust Services (Singapore) Limited, in

its capacity as trustee of CLAR, and was carried out by JLL Valuation & Advisory Services LLC using the direct

capitalisation and discounted cash flow approaches.

ANNEX

Property Highlights

| Address | 8695 Basil Western Road, Canal Winchester, Ohio 43110 |

| Description | A modern, Class A single-storey logistics building |

| Land Tenure | Freehold |

| Gross Floor Area/ Net Lettable Area | 755,160 sq ft |

| Occupancy Rate | 100% |

| Weighted Average Lease Expiry (by rental income) | Approximately 5 years |

Location:

About CapitaLand Ascendas REIT (www.capitaland-ascendasreit.com) CapitaLand Ascendas REIT (CLAR) is Singapore’s first and largest listed business space and industrial real estate investment trust. It was listed on the Singapore Exchange Securities Trading Limited (SGX-ST) in November 2002.

CLAR has since grown to be a global REIT anchored in Singapore, with a strong focus on tech and logistics properties in developed markets. As at 30 September 2025, its investment properties under management stood at S$17.7 billion. It owns a total of 231 properties across three segments, namely Business Space & Life Sciences; Industrial & Data Centres; and Logistics. These properties are in the developed markets of Singapore, Australia, the US, and the UK/Europe.

These properties house a tenant base of approximately 1,790 international and local companies from a wide range of industries and activities, including data centres, information technology, engineering, logistics & supply chain management, biomedical sciences, financial services (backroom office support), electronics, government and other manufacturing and services industries. Major tenants include Sea Group, DSO National Laboratories, Stripe, Entserve UK, Singtel, DBS Bank, Seagate Singapore, DHL, and Citibank.

CLAR is listed on several indices. These include the FTSE Straits Times Index, the Morgan Stanley Capital International, Inc (MSCI) Index, the European Public Real Estate Association/National Association of Real Estate Investment Trusts (EPRA/NAREIT) Global Real Estate Index, the Global Property Research (GPR) Asia 250 Index and FTSE4Good Developed Index. CLAR has an issuer rating of ‘A3’ by Moody’s Investors Service.

CLAR is managed by CapitaLand Ascendas REIT Management Limited, a wholly owned subsidiary of CapitaLand Investment Limited, a leading global real asset manager with a strong Asia foothold.

About CapitaLand Investment Limited (www.capitalandinvest.com) Headquartered and listed in Singapore in 2021, CapitaLand Investment Limited (CLI) is a leading global real asset manager with a strong Asia foothold. As at 5 November 2025, CLI had S$120 billion of funds under management. CLI holds stakes in eight listed real estate investment trusts and business trusts and a suite of private real asset vehicles that invest in demographics, disruption and digitalisation-themed strategies. Its diversified real asset classes include retail, office, lodging, industrial, logistics, business parks, wellness, self storage, data centres and private credit.

CLI aims to scale its fund management, lodging management and commercial management businesses globally and maintain effective capital management. As the investment management arm of CapitaLand Group, CLI has access to the development capabilities of and pipeline investment opportunities from CapitaLand’s development arm.

CLI is committed to growing in a responsible manner, delivering long-term economic value and contributing to the environmental and social well-being of its communities.

Issued by: CapitaLand Ascendas REIT Management Limited (Co. Regn.: 200201987K)

For queries, please contact:

Analyst contact

Andrea Ng

Assistant Vice President, Listed

Funds, Investor Relations

Tel: +65 6713 1150

Email: [email protected]

Media contact

Joan Tan

Vice President, Group

Communications Tel: +65 6713 2864

Email: [email protected]

This news release may contain forward-looking statements. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements because of several risks, uncertainties, and assumptions. Representative examples of these factors include (without limitation) general industry and economic conditions, interest rate trends, cost of capital and capital availability, availability of real estate properties, competition from other developments or companies, shifts in customer demands, shifts in expected levels of occupancy rate, property rental income, charge out collections, changes in operating expenses (including employee wages, benefits and training, property operating expenses), governmental and public policy changes and the continued availability of financing in the amounts and the terms necessary to support future business.

You are cautioned not to place undue reliance on these forward-looking statements, which are based on the current view of management regarding future events. No representation or warranty express or implied is made as to, and no reliance should be placed on, the fairness, accuracy, completeness or correctness of the information or opinions contained in this news release. Neither CapitaLand Ascendas REIT Management Limited (“Manager”) nor any of its affiliates, advisers or representatives shall have any liability whatsoever (in negligence or otherwise) for any loss howsoever arising, whether directly or indirectly, from any use of, reliance on or distribution of this news release or its contents or otherwise arising in connection with this news release.

The past performance of CapitaLand Ascendas REIT (“CLAR”) is not indicative of future performance. The listing of the units in CLAR (“Units”) on the Singapore Exchange Securities Trading Limited (“SGX-ST”) does not guarantee a liquid market for the Units. The value of the Units and the income derived from them may fall as well as rise. Units are not obligations of, deposits in, or guaranteed by, the Manager. An investment in the Units is subject to investment risks, including the possible loss of the principal amount invested. Investors have no right to request that the Manager redeem or purchase their Units while the Units are listed on the SGX-ST. It is intended that holders of Units may only deal in their Units through trading on the SGX-ST.

This news release is for information only and does not constitute an invitation or offer to acquire, purchase, or subscribe for the Units.